The Apple Card Financial savings rate of interest has been elevated a second time, simply two weeks after a earlier hike. The annual share yield (APY) is now 4.35%.

Whereas there are nonetheless higher offers on the market, Apple does appear to be aiming to stay broadly aggressive, because it seeks a brand new accomplice financial institution …

Apple Card Financial savings rate of interest

The Apple Card Financial savings Account is an possibility for Apple Card accounts, first launched in late 2022. Cardholders can decide to have their Each day Money rewards mechanically transferred to a separate financial savings account, and extra deposits could be made manually.

On the time of launch, the account paid 4.15% APY, which was respectable, although falling wanting one of the best offers on the market.

A few weeks in the past, the account received its first ever price enhance, to 4.25%.

Apple introduced the boosted rate of interest in a push notification despatched to Apple Card Financial savings Account customers on Wednesday night. The 4.25% APY is much better than the business common, however nonetheless lower than choose different high-yield financial savings accounts.

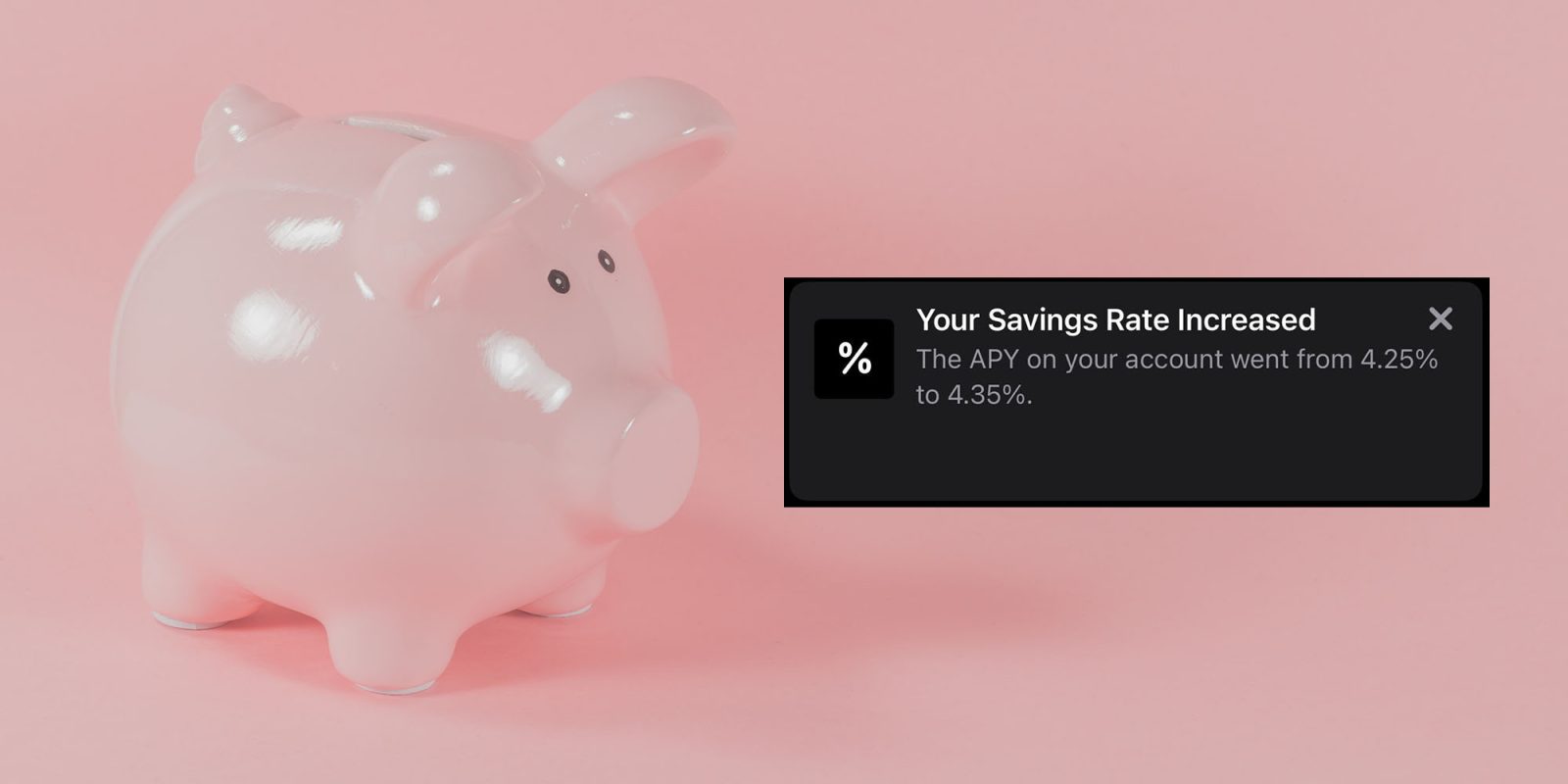

Apple yesterday despatched a push notification to account holders, advising that the speed has once more been elevated.

Your Financial savings Charge Elevated

The APY in your account went from 4.25% to 4.35%.

It’s nonetheless the case that you could find higher offers – together with from present Apple Card accomplice financial institution, Goldman Sachs. Its Marcus-branded financial savings account at present affords 4.5% APY, whereas PNC affords 4.65% and UFB hits 5.25%.

Nonetheless, the place Apple Card wins is comfort and painless saving. Whenever you make Apple Card purchases, you earn rewards which could be mechanically transferred into your financial savings account, primarily making a financial savings pot with none price or effort.

Understanding APY

The yield of financial savings accounts is measured by annual share yield (APY). That is the efficient rate of interest you get by placing cash into the account and leaving it there, so consists of compound curiosity.

That’s, every time curiosity is added to the account, it applies to the most recent account stability – which was elevated by the earlier curiosity funds. Right here’s an instance offered by Investopedia:

Think about investing $1,000 at 6% compounded month-to-month. Initially of your funding, you could have $1,000. After one month, your funding may have earned one month’s value of curiosity at 6%. Your funding will now be value $1,005 ($1,000 * (1 + .06/12)). At this level, we have now not but seen compounding curiosity.

After the second month, your funding may have earned a second month of curiosity at 6%. Nonetheless, this curiosity is earned on each your preliminary funding in addition to your $5 curiosity earned final month. Subsequently, your return this month might be better than final month as a result of your funding foundation might be greater. Your funding will now be value $1,010.03 ($1,005 * (1 + .06/12)). Discover that the curiosity earned this second month is $5.03, which is completely different from the $5.00 from final month.

After the third month, your funding will earn curiosity on the $1,000, the $5.00 earned from the primary month, and the $5.03 earned from the second month. This demonstrates the idea of compound curiosity: the month-to-month quantity earned will regularly enhance so long as the APY doesn’t lower and the funding principal isn’t decreased.

The APY is a straightforward strategy to perceive the general return achieved.

Photograph by Pawel Czerwinski on Unsplash

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.