The iPhone 15 and its many iterations comprised greater than half of Apple’s This fall smartphone shipments of two.8 million models in India, Canalys stated in its quarterly report. The handset has seen outstanding success in India as Apple pushed the newest fashions in the course of the festive gross sales, which happen throughout on-line and offline channels within the nation whereas its massive inhabitants celebrates Diwali within the final quarter of the yr and produce reductions and presents to draw prospects.

Whereas Diwali — the pageant of sunshine — often is available in October, it occurred in November final yr, per the Hindu calendar, which gave Apple room to push the iPhone 15 throughout pageant gross sales, Sanyam Chaurasia, senior analyst at Canalys, advised TechCrunch.

Apple launched the iPhone 15 sequence with just a few noticeable adjustments over its earlier generations, together with USB-C, the capsule-shaped Dynamic Island and matte again end throughout all fashions. These adjustments have attracted new and current iPhone consumers in India, the place Android dominates with over 95% market share.

Along with the design-level adjustments, straightforward financing, higher shopper surroundings and growing retail presence helped Apple to make the iPhone 15 sequence extra interesting to Indian prospects than any of its earlier generations, Chaurasia stated.

Apple began promoting the iPhone 15 sequence in India within the first batch of its availability in September. For the primary time, the preliminary iPhone lot that went on sale was domestically assembled within the nation, because the Cupertino firm, much like different smartphone makers, considers the South Asian nation its world manufacturing hub and expanded its native manufacturing footprint.

Apple remains to be not a prime smartphone vendor on the planet’s second-biggest smartphone market and captured a negligible share — 7% particularly — within the fourth quarter, based on Canalys.

Chaurasia advised TechCrunch Apple’s shipments grew near 32% quarter-on-quarter within the fourth quarter.

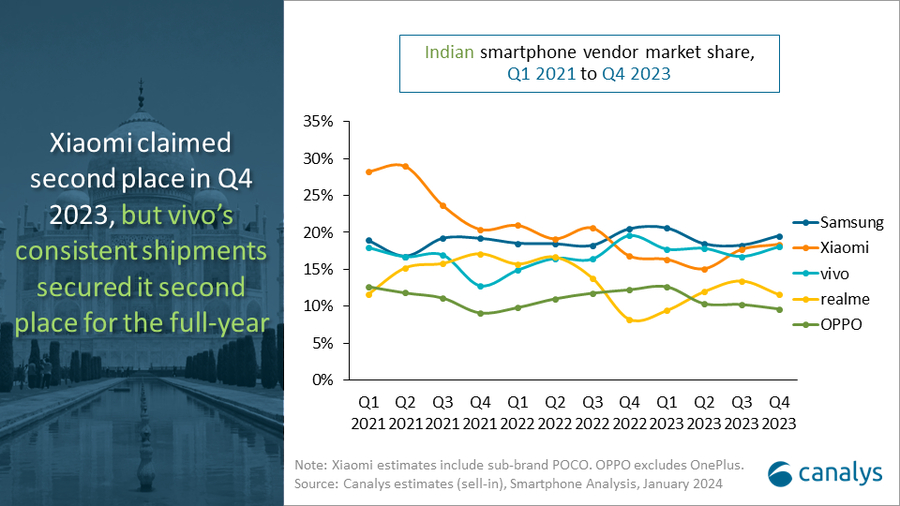

Samsung and Xiaomi emerged as the 2 main smartphone distributors within the Indian market within the fourth quarter, with 21% and 17% share, respectively. However, Vivo secured its second place after Samsung in full-year shipments, with a 3% annual development by transport 26.1 million smartphone models in 2023, serving to to seize a share of 18% — simply 1% lower than the South Korean firm, which noticed 1% drop in its annual development by transport 28.4 million models.

Picture Credit: Canalys

The important thing purpose Apple has not but been a number one smartphone maker in India from a shipments perspective is the excessive pricing of the iPhone fashions within the nation, which is dwelling to numerous price-sensitive consumers. Regardless of native assembling, the retail iPhone value in India remains to be considerably larger than within the U.S. For example, the iPhone 15, which begins at $799 within the U.S., retails at 79,900 Indian rupees ($961). Nevertheless, the typical smartphone promoting value within the Indian market is round $250 — not like $790 within the U.S.

Nonetheless, Apple is changing into a acquainted model within the Indian smartphone market and is quickly rising its native presence. The corporate noticed the highest-ever quarterly iPhone shipments within the nation within the third quarter, with over 2.5 million iPhone models shipped between July and September, per Counterpoint. The iPhone maker additionally opened two of its bodily shops in India final yr to increase its advertising efforts and attraction to extra Indian customers.

General, Indian smartphone shipments went again on monitor after seeing a decline for 5 quarters consequently, with a 20% year-on-year development within the fourth quarter, with practically 39 million models shipped, Canalys famous. Nevertheless, the nation noticed a minimal 2% yearly drop, with 148.6 million smartphone models shipped in 2023.

“In 2023, rising funding in mainline retail house proved useful not just for distributors but additionally allowed the general market to stabilize,” Chaurasia stated within the report. “Canalys expects the Indian smartphone market to develop by mid-single digits in 2024, pushed by reasonably priced 5G and the pandemic interval alternative cycle. However the largest problem for distributors this yr might be to handle the rising invoice of supplies prices.”