Information has develop into a vital driver for brand spanking new monetization initiatives within the monetary providers business. With the huge quantity of knowledge collected from prospects, transactions, and market actions, amongst different sources, this abundance provides great potential for monetary establishments to extract useful insights that may inform enterprise choices, enhance customer support, and create new income streams. With the emergence of recent applied sciences, together with privateness enhancing strategies (PETs) that additional defend the shopper, monetizing information has develop into extra accessible than ever earlier than.

Contemplating at the moment’s mobile-first-, mobile-almost-everything world, there was a surge in using cell banking purposes, solely accelerated by the COVID-19 pandemic. With extra folks counting on cell digital transactions to examine balances, make deposits and funds, and execute trades, monetary providers companies are in a position to acquire an enormous quantity of knowledge on a variety of buyer conduct. These information and different sources symbolize key alternatives for information monetization. By leveraging these information and making a data-driven tradition, companies can generate new income streams and enhance their operations.

Third celebration alternatives

A technique for monetary providers companies to monetize their information is by promoting it to 3rd events.

Listed below are some related examples from throughout the business:

- Retail banks can promote their buyer transaction information to advertising companies which are concerned with understanding shopper conduct.

- Industrial banks can even promote information on enterprise transactions and credit score historical past to credit standing businesses and different monetary establishments.

- Wealth managers can monetize their information by promoting analytics and insights to their purchasers, comparable to custom-made funding suggestions based mostly on a person’s monetary objectives and threat profile.

- Asset and fund managers can promote information and analytics to their purchasers, comparable to efficiency information on totally different funding portfolios.

- Inventory exchanges can monetize their information by promoting real-time market information to monetary establishments and information organizations concerned with monitoring market traits and actions.

- Central banks can promote information on financial indicators and financial coverage to monetary establishments and researchers.

Creating new services

Along with promoting information, monetary providers companies can even monetize their information through the use of it to create new services. Buyer 360 initiatives allow hyper-personalization to focus on the suitable buyer with the subsequent greatest motion, which ends up in extra engaged prospects and higher outcomes from information monetization.

For instance, a retail financial institution can use buyer transaction information to develop personalised monetary merchandise, comparable to bank cards and funding portfolios, tailor-made to particular person wants. Funding banks can use information on market traits and investor conduct to create new monetary services, comparable to derivatives and structured finance merchandise.

Factoring in compliance

Nevertheless, defending buyer information and adhering to information privateness legal guidelines is vital for monetary providers companies. The phrase “with nice energy comes nice duty” involves thoughts. In an effort to monetize their information whereas nonetheless respecting the privateness of their prospects, these companies should implement strong information safety measures and cling to related rules. This contains implementing sturdy safety measures, comparable to encryption and multi-factor authentication, and solely accumulating and utilizing information with buyer consent.

Monetary providers companies should additionally rigorously contemplate how they share information with third events, getting into into information sharing agreements that define the phrases and circumstances for information use. As well as, they need to adjust to related information privateness legal guidelines, such because the Normal Information Safety Regulation (GDPR) and the California Client Privateness Act (CCPA), and be clear about their information safety practices.

Shifting to a data-driven tradition

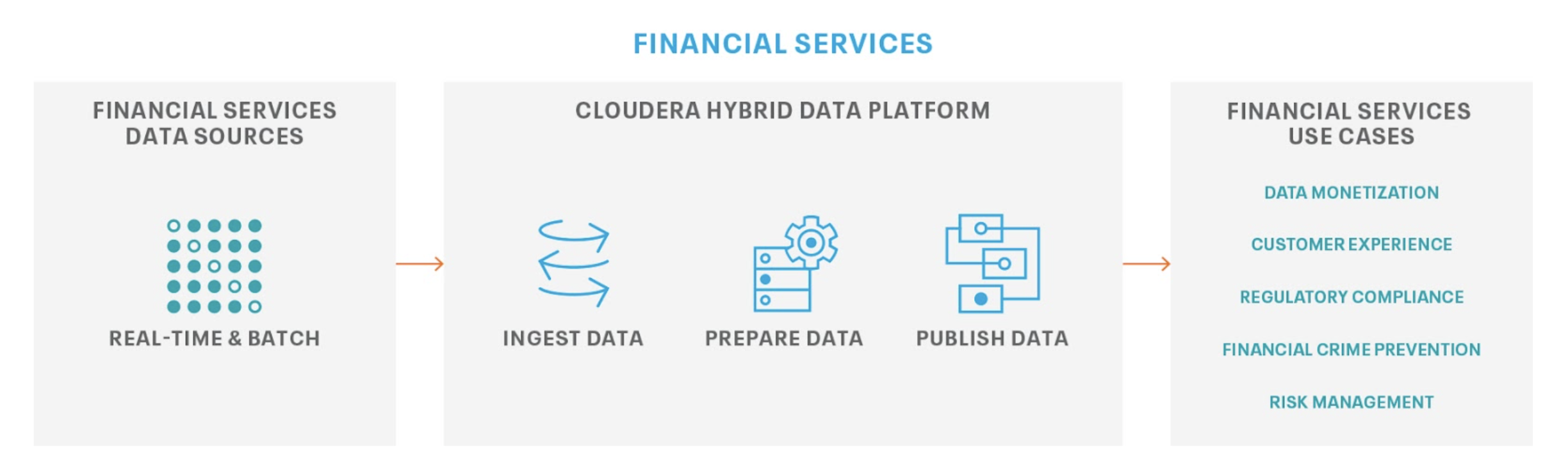

To completely understand the worth of their information, monetary providers companies should create a data-driven tradition that prioritizes using information in decision-making and innovation. This contains investing in trendy information structure, comparable to utilizing a platform like Cloudera, which allows corporations like Santander UK to retailer, course of, and analyze massive quantities of knowledge in actual time. By utilizing information to tell their methods and operations, monetary providers companies can higher perceive their prospects, enhance their threat administration, and establish new alternatives for development.

General, there are a lot of methods for monetary providers companies to monetize their information, together with promoting it to 3rd events and utilizing it to create new services. By adopting a data-driven tradition and investing in trendy information structure, these companies can higher leverage their information to drive innovation and generate new income streams whereas additionally defending the privateness of their prospects.

Find out how monetary providers companies are leveraging Cloudera for data-driven use instances from buyer retention and profitability to decreasing fraud and threat publicity.