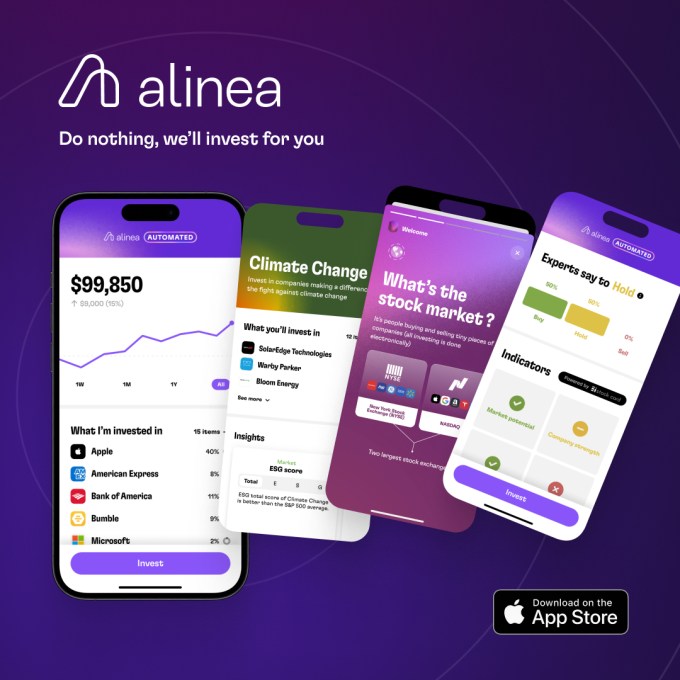

Alinea Make investments, a fintech app providing AI-powered wealth administration geared toward Gen Z girls, has $3.4 million in seed funding forward of the launch of a digital AI assistant that can assist customers with their investing wants. The fundraising comes on the heels of 225,000 downloads of Alinea’s app, resulting in a income run-rate of $1.8 million, permitting the New York space startup’s six-person workforce to function profitably.

Based amid the Covid-19 pandemic, Alinea was created by co-founders Anam Lakhani and Eve Halimi, in addition to CTO Daniel Nissenbaum who met at Barnard School and Columbia College. Lakhani and Halimi, now co-CEOs, had interned on Wall Road however confronted an analogous ache level when it got here to cash: they didn’t know the way to greatest make investments. This concept led to the creation of a marketing strategy for an app whereas taking an entrepreneurship class in school. Later, the founders headed into full-time jobs in funding banking and at a development stage startup when Covid hit.

The pandemic finally freed up extra time for the workforce to work on their app, so that they utilized to startup accelerator Y Combinator in 2021 and obtained in.

“The ache level we noticed is that individuals like us who’re younger girls, Gen Zs, kids of immigrants, they do not know the place to begin. Monetary literacy is an enormous ache level throughout america,” notes Lakhani. “We wished to construct an alternate platform that was actually customized, taught you the way to construct your wealth, and did it for you.”

Alinea Hallima Eve in orange and Lakhani Anam/credit score: Alinea Make investments

The app, which is described as a “Wealthfront meets Robinhood,” is constructed with a Gen Z viewers in thoughts. That features a heavy deal with an approachable design to make investing appear much less intimidating. The aim is to draw customers as they’re simply leaving school and coming into the workforce or getting their first paychecks, then serving to them to automate their portfolio. This differentiates Alinea from different female-focused fintechs, like Ellevest.

Many customers begin with Alinea’s automated investing mannequin, however later make the most of the choice to purchase and promote shares as they grow to be extra subtle traders.

Nevertheless, not like Robinhood and a few others, Alinea operates on a subscription enterprise mannequin that prices a flat $120 per yr.

One other differentiator for Alinea are its “playlists.” These let customers construct their very own direct indexes — in a means that’s considerably akin to curating music on Spotify. Immediately, Alinea traders have custom-made their very own ETFs round themes like local weather change, feminine management, AI, vogue, and even abortion rights. Each day, customers create 1000’s of playlists, and these will also be shared with others.

Picture Credit: Alinea Make investments

The corporate thus far has been profitable at buying customers by means of content material advertising, notably on TikTok, the place the founders discuss investing and their startup journey. Up to now, their following has led to over 100 million views throughout their hashtags on the brief video platform, the founders informed TechCrunch.

With the seed spherical of $3.4 million, Alinea desires to maneuver additional into the AI market with the launch of an AI monetary advisor. Whereas the app is already leveraging a mixture of AI and professional advisors to make inventory suggestions, the brand new characteristic, due out later this yr, will provide an interactive approach to ask for investing assist.

The AI helper can be tacked onto a brand new subscription.

“There can be an extra upscale tier, basically, the place it is going to be like a type of AI copilot — an AI monetary advisor that can reply all of your questions…which are very customized to you,” notes Halimi.

The AI will think about quite a lot of components when answering questions, together with the person’s age, threat tolerance, previous monitor report, and extra. The workforce expects to launch the characteristic round Q2 or Q3 this yr, they mentioned.

Although competitors is rife within the fintech area, Alinea believes they’ll seize a selected demographic — the youthful, Gen Z investor, and largely girls. (80% of the app’s customers are girls). The common Alinea investor makes $80,000 per yr and is round 22 to 24 years outdated.

The brand new funding was led by F7 Ventures and GFR and included Worklife Ventures (Bri Kimmel), FoundersX Fund, Gaingels, and Dropbox co-founder Arash Ferdowsi. Alinea had beforehand raised a $2.3 million pre-seed spherical from Goodwater, Kima Ventures, Harvard, Diaspora, and ex-Robinhood workers. The founders haven’t added to the board with the brand new capital, however moderately plan to spend money on additional product improvement, together with the AI copilot, personalization, and different instructional initiatives.

“Monetary literacy and investing is a vital path to wealth and monetary stability for girls and Gen Z,” mentioned Kelly Graziadei, F7 Normal Accomplice. “We’re proud to spend money on Eve & Anam as they construct AI-powered investing with Alinea — making it simpler and extra accessible than ever for folks to speculate in keeping with their pursuits and values. We will’t consider a greater workforce to open up the trail to a brand new technology of wealth creation,” she added.