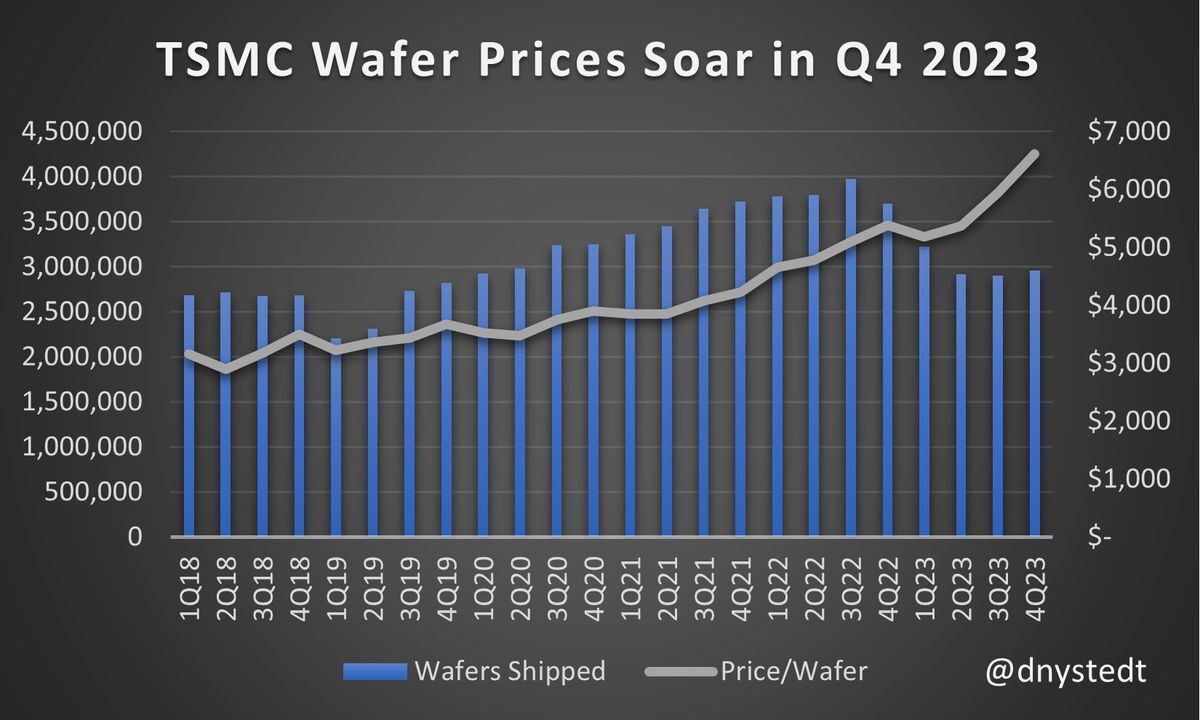

You would possibly assume that the world’s main foundry, Taiwan’s TSMC, is getting spanked financially by a bleak chip business that has seen demand for wafers decline. For instance, TSMC reported that it shipped 2.96 billion 12-inch wafers throughout the fourth quarter of 2023. That was down 20.1% from the earlier 12 months’s deliveries of three.7 billion 12-inch wafers. Regardless of this sharp decline, TSMC’s This autumn revenues for 2023 got here in at $19.62 billion which was down only one.5% from the $19.93 billion reported throughout the identical quarter in 2022.

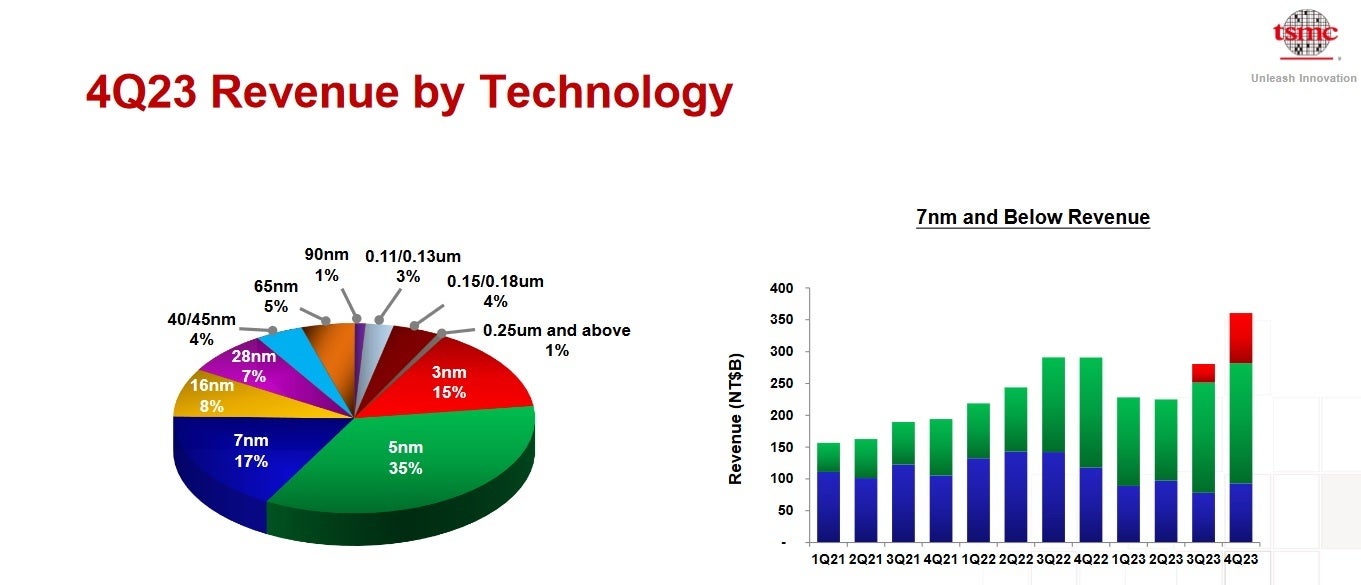

15% of TSMC’s This autumn income was from 3nm chips

After all, the extra you progress away from the newest cutting-edge course of node, the cheaper the worth of the wafers. 15% of TSMC’s fourth-quarter income got here from its N3 (3nm course of node). TSMC took in $2.943 billion from 3nm, N5 (5nm) know-how introduced in $6.867 billion, and N7 (7nm) know-how yielded $3.3354 billion. TSMC’s superior know-how nodes (N3/N5/N7) accounted for 67% of TSMC’s whole wafer income in This autumn 2023.

TSMC’s wafer costs have been trending larger

Ultimately, demand for chips will begin heading again up, and together with rising wafer costs, TSMC ought to begin reporting robust quarterly numbers.