Apps like Robinhood made investing in shares simpler, and Finvest needs to do the identical factor for investing in U.S. Treasury Payments.

Shivam Bharuka, co-founder and CEO of Get Shifting, began engaged on Finvest in 2023. With rates of interest at such excessive ranges, Bharuka wished to make the most of the surroundings, nevertheless, banks have been giving pennies on the greenback, he advised TechCrunch.

“With the excessive rates of interest, you mainly earn free cash on idle money by U.S. Treasury Payments. However, there isn’t a simple method to purchase Treasury Payments immediately,” Bharuka mentioned. “You should purchase them by the federal government web site, Treasury Direct, which is an expertise from the Nineteen Nineties, or use the legacy brokerages like Constancy or Charles Schwab. These experiences are sometimes opaque, and include a clunky person expertise. Most trendy fintech apps additionally don’t allow you to spend money on underlying fixed-income belongings.”

He was a part of the Winter 2023 Y Combinator cohort, nevertheless, Bharuka initially went in a logistics-focused firm for India. He ended up pivoting when he observed the ache factors related to shopping for Treasury Payments.

He and his workforce are growing Finvest to make the acquisition, administration and promoting of U.S. Treasury Payments seamless. Pershing Advisor Options LLC, a subsidiary of the Financial institution of New York Mellon Corp., serves because the brokerage agency.

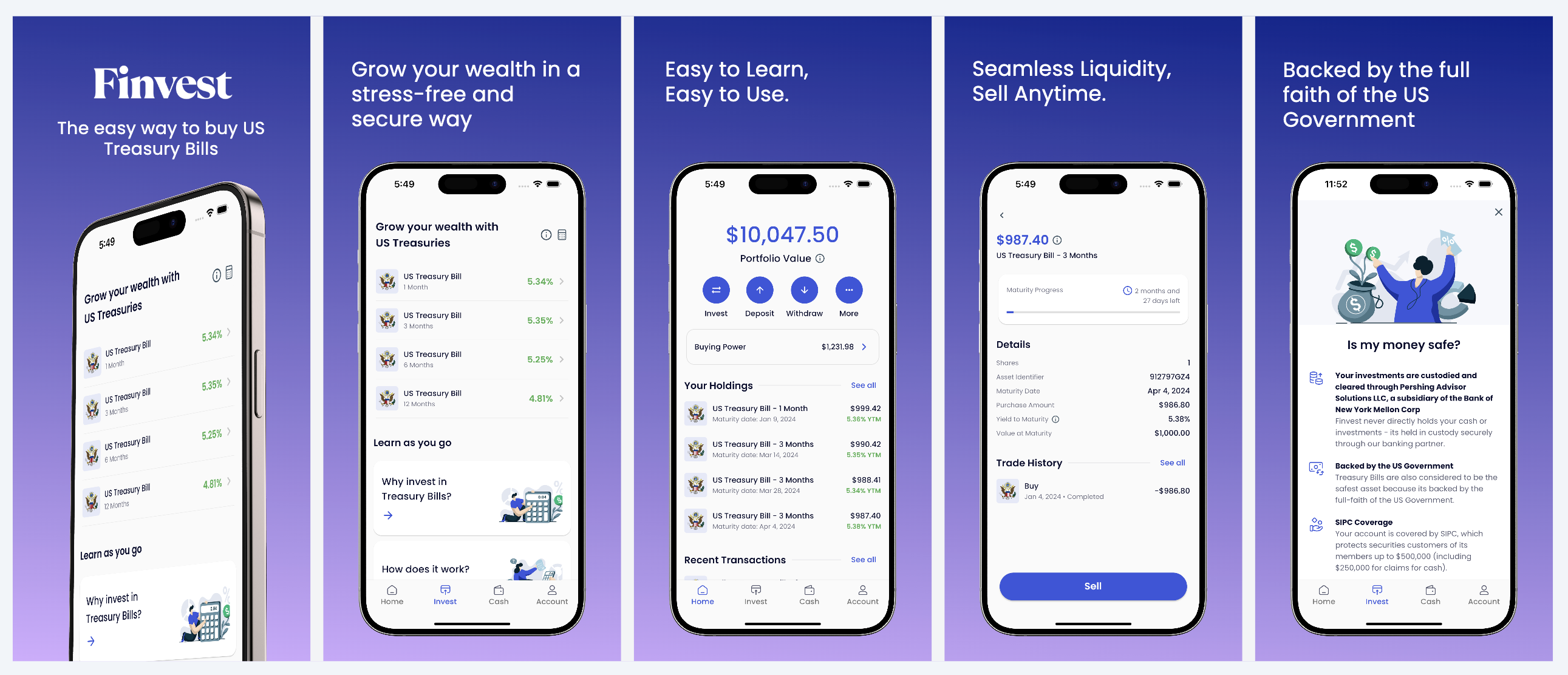

Finvest’s funding app options. (Picture credit score: Get Shifting)

Right here’s the way it works: After downloading both the iOS or Android app, customers create an account, add a checking account and provoke a deposit. Sometimes, there’s a one-day verification course of for making a brokerage account. Nevertheless, Finvest permits the deposit to be teed up so that when the account is authorized, the commerce will begin going by.

Finvest fees a flat administration charge of 0.03% per 30 days on the common day by day market worth of your Treasury belongings and month-to-month administration charges.

Bharuka shouldn’t be alone in desirous to make this course of simpler. Zamp Finance, is backed by Sequoia, supplies a treasury administration platform for higher entry to U.S. Treasury Payments. Finvest sweetens its providing with a high-yield money administration account that provides you a 4.4% yield, larger than most financial savings accounts.

The corporate is in its earliest phases, with Bharuka declining to say what number of clients have downloaded, however did say that round $1 million in deposits have been made since launching in December.

It additionally already grabbed $2.7 million in funding from an investor group that features Bayhouse Capital, Unpopular Ventures, Y Combinator, Olive Tree Capital, Pioneer Fund, Fractal Ventures and a bunch of angel buyers, together with former Airbnb government Oliver Jung.

Bharuka plans to make use of the funding to increase Get Shifting’s engineering workforce and finally add different asset courses to the Finvest app, for instance, company bonds and municipal bonds.

“We’re additionally planning to launch this internationally as effectively,” he mentioned. “We’ve got been exploring this angle as a result of there’s a variety of curiosity to take a position into treasuries, particularly in Latin nations, like Argentina or Brazil, as a result of their financial economies haven’t been that sturdy. They wish to spend money on a stronger financial system, however there isn’t a direct method to do it immediately.”