The report cites two causes for the slowdown in foldable cellphone shipments. The primary cause, says TrendForce, is that client retention is low as first-time homeowners of those units have been experiencing upkeep points with these telephones. This, says the report, has led to a “insecurity” in foldables. The consequence, says the report, is that customers aren’t shopping for a second foldable and are turning to flagship telephones as an alternative.

Huawei’s new Pocket 2 clamshell sports activities 4 cameras

The second cause has to do with the pricing of those telephones. Pricing has but to, “attain the candy spot for customers,” TrendForce says. The report notes that mass manufacturing of key elements akin to Extremely Skinny Glass and hinges may assist convey down their costs finally leading to decrease prices to customers. Moreover, Chinese language panel suppliers are rising their shipments and these corporations cost much less for his or her foldable panels than the Korean show corporations akin to Samsung Show and LG Show.

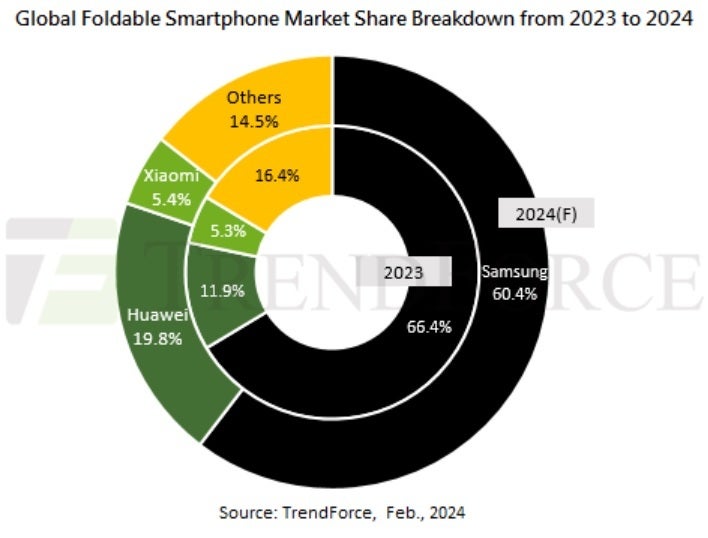

2023 foldable market shares and 2024 forecasts

For this yr, Pattern Drive expects Samsung to remain on prime with 60.4% of the foldable market, and Huawei, which simply introduced its quad-camera Pocket 2 clamshell, is aiming to take 19.8% of the market with aggressive shipments of its foldable units. Huawei can be rumored to be engaged on a tri-fold foldable as is Samsung and this might give the foldable market a much-needed shot within the arm.