Particular because of Barb MacLean, SVP, Head of Know-how Operations and Implementation at Coastal Group Financial institution (Coastal) and Rob Cavallo, President at Cavallo Applied sciences for his or her useful insights and contributions to this weblog.

Prospering as a group financial institution amongst Goliaths

In some methods, it has by no means been harder to be a group financial institution. The highest 15 banks within the U.S. now management a lot of the business’s deposits and property, with the most important 5 banks managing 56% of complete property. Moreover, regulatory calls for are growing for smaller banks, requiring them to comply with the identical stringent capital, reporting, and anti-money laundering requirements as their bigger opponents. For Barb MacLean, SVP, Head of Know-how Operations and Implementation at Coastal Group Financial institution (Coastal), the answer is Banking-as-a-Service (BaaS). To learn extra about how Coastal is utilizing Delta Sharing to deal with a posh information atmosphere, learn the case research. On the core, Coastal’s imaginative and prescient is to offer BaaS to trusted monetary suppliers, with the objective of uniting companions to alternate buyer information, providing tailor-made monetary merchandise, streamlined reporting and compliance, and enhanced fraud detection.

One such companion is One — an rising fintech startup. By means of its information sharing structure constructed on the Databricks Information Intelligence Platform, Coastal has fostered a collaborative partnership with One by means of the sharing of account and different buyer information to make sure a seamless banking expertise that its prospects can belief.

One is accessible to Walmart’s 1.6 million associates and 150M+ weekly customers along with being out there to shoppers all over the place. Given the attain of One, the size of knowledge for even transactional parts they give the impression of being to share with Coastal every day quickly hits a restrict by way of tips on how to transfer that quantity of knowledge simply, safely and securely whereas assembly monetary processing time home windows.

Actual-time information sharing and collaboration hampered by complicated legacy techniques

Coastal’s CCBX division has shaped a partnership with fintech startups like One, the place it provides banking providers for One’s on-line banking choices. This required integrating completely different information techniques to make sure seamless buyer transitions and up-to-date interactions, all whereas sustaining strict information safety and privateness requirements.

“We cope with an atmosphere filled with legacy applied sciences and dynamic companion environments, with third-party involvement and altering business necessities,” defined MacLean. “Now we have to tackle the duty to serve them properly. We simply cannot operationalize our companion community with an rigid platform.” For MacLean, this meant constructing an information basis that may be versatile sufficient to work with numerous sources with out imposing pointless complexity on different organizations.

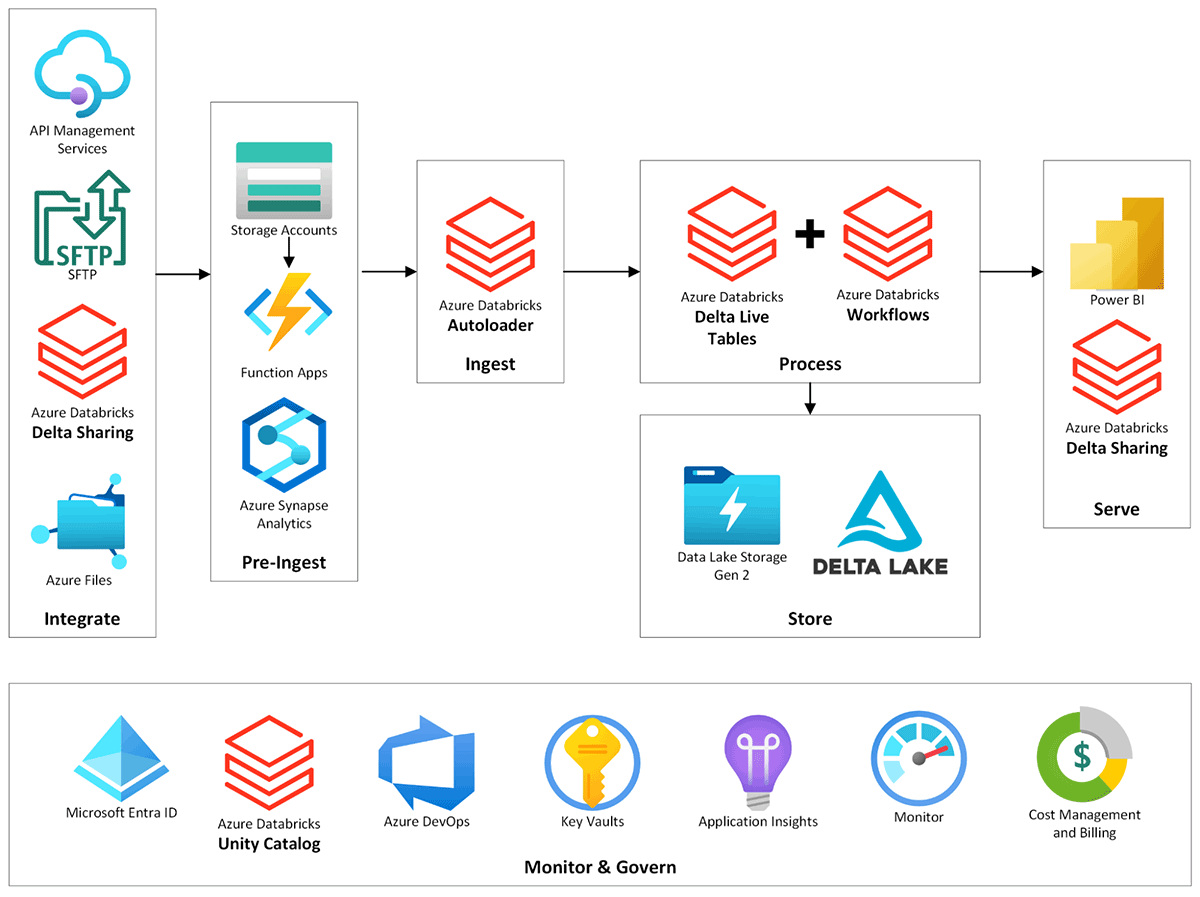

Embarking on its journey towards a extra collaborative strategy to group banking and banking-as-a-service (BaaS), Coastal selected Cavallo Applied sciences to assist develop a contemporary information platform to help its stringent buyer information sharing and compliance necessities. “In some methods, Coastal was asking for a paradox: allow straightforward collaboration but meet the best safety requirements for client monetary information. It is vital to make sure the platform is performant and cost-effective for at present’s workloads whereas additionally adaptable sufficient to deal with future use circumstances not but imagined. Ultimately, the Databricks Information Intelligence Platform was the one platform we discovered that empowered us to try this,” stated Rob Cavallo, President at Cavallo Applied sciences. Regardless of the problem of balancing accessibility with safety, they present in Databricks an answer that was environment friendly, cost-effective, and versatile for each present and future wants.

Sharing information throughout platforms, clouds and areas with robust safety and governance

The One crew had been seeking to deprecate their use of Google BigQuery as they wanted a unified platform for engineering, analytics, and information science that supported a number of languages, help for reworking and inferring semi-structured information, native orchestration, and streaming.

The crew was capable of shortly share information and management entry at a granular stage with Delta Sharing. Transferring to Databricks as its new platform, Coastal was capable of begin receiving related information tables in a safe workspace with One’s information crew in lower than ten minutes – one thing they weren’t capable of accomplish after weeks of scuffling with Google BigQuery.

With Coastal processing transactions for One, their enterprise crew requested abstract reviews to return on Saturdays. Beforehand this may have required Coastal to rent extra employees to cowl on weekends since this was all executed manually. However with Databricks, Coastal was capable of automate report technology and supply dependable supply to its companions. “This simply wasn’t doable with our prior tooling, plain and easy,” stated MacLean.

As a part of their distinctive relationship and integrations with Walmart, One is accessible to Walmart’s 1.6 million associates and 150M+ weekly customers along with being out there to shoppers all over the place. Given the attain of One, the size of knowledge for even transactional parts they give the impression of being to share with Coastal every day quickly hits a restrict by way of tips on how to transfer that quantity of knowledge simply, safely and securely whereas assembly monetary processing time home windows.

Collectively, with companions like One, Coastal has seen important buyer development that exhibits no indicators of slowing down. Since prospects at all times anticipate and demand real-time entry to their cash, Coastal’s infrastructure should help real-time transactions at present and sooner or later, and at a scale past which most banks function. “In the event you’re transferring a greenback or one million {dollars} in a transaction, it is irrelevant to the techniques required to help these transactions,” defined Cavallo.

Remodeling infrastructure that delivers long-term buyer worth

- Consolidated ETL operations by changing SAS, Azure Information Manufacturing facility, and handbook Python scripts with a unified system, resulting in important price financial savings and the retirement of outdated infrastructure.

- Developed an automatic monetary transaction system that meets regulatory necessities, chopping processing prices by 80%, enhancing accuracy, and simplifying audits.

- Overhauled a vital scoring engine to ship leads to half-hour as an alternative of 48 hours, enabling it to function autonomously with detailed output for enterprise decision-making.

Studying vital classes by means of the transformation journey

Alongside the best way, an intensive analysis of competitor merchandise and area of interest information platforms focused at monetary providers was constantly carried out. This openness to the concept there could also be a greater answer, and validating that none of these different applied sciences had been match for goal reinforces the selection of Databricks as the absolute best answer. General, the conclusion was that simplicity and unification at all times win.

One other studying was success requires extra than simply area experience. “Efficient teamwork hinges on a mix of technical consultants, enterprise specialists, and people adept at managing intricate discussions. In different phrases, everybody should verify their egos on the door and work collectively to succeed in the widespread objective. That is crucial,” says MacLean. “Collaboration and humility are important.”

Coastal believes in automating routine duties to liberate engineers for higher-value work. Databricks simplifies workflows, permitting engineers to deal with understanding buyer challenges and devising options, thus including extra worth to the corporate. This strategy allows engineers to tackle wider roles with out the necessity for further groups to handle cross-functional initiatives, giving Coastal a aggressive edge by means of full possession of the method from begin to end.

The most important lesson for Coastal in its efforts was that in an business of giants, small groups can win too. When operational workflows are streamlined and know-how unified, the constraints that sometimes maintain again groups are eradicated — placing these groups of extremely expert, innately motivated collaborators able to assist the enterprise make transformative choices.

Persevering with to expertise the advantages of a unified platform

Databricks Information Intelligence Platform is the one platform that permits Coastal to harness the complexity of knowledge engineering and infrastructure administration, as an alternative of being buried beneath it. This manner, its crew can proceed to fulfill and exceed expectations for the financial institution. “We by no means need to go and discover out if the platform can do it,” explains Cavallo. As an alternative of losing useful time determining the place every device ought to match, Coastal can deal with executing quicker, cheaper, and extra effectively. As an illustration, with out Delta Reside Tables and Unity Catalog, many workarounds — and customized options requiring upkeep and governance groups — would have been required. To not point out, Coastal engineers’ capacity to leverage the tooling to alert, quarantine, and reply to numerous manufacturing occasions. “From a useless sleep to automated on-call callouts on the off-chance they occur, time to decision has been as quick as eighteen minutes,” explains MacLean.

Moreover, the help from the Databricks crew has been unparalleled, making the Coastal crew really feel as if they’re its most vital buyer. The crew loves working with this toolset, and so they get full credit score for what they have been capable of do and ship with these instruments in hand. With shut engagement with the Databricks crew, Coastal was capable of understand a 25% price discount in a single afternoon with minimal effort. In one other case, they’d a request from the financial institution’s management which beforehand would have taken a number of days and even weeks to answer. By means of the efforts of a small crew of 10 information engineers and utilizing the Databricks Information Intelligence Platform, utilizing information sharing and governance options reminiscent of information lineage in Unity Catalog, they offered the reply from throughout their dataset inside hours. This pairing of Databricks’ experience and the small, high-agency crew at Coastal is how a small group financial institution cannot solely survive but in addition thrive.

“We have delivered two years’ price of labor in 9 months with Databricks as our underlying platform. Our groups can now entry a single supply of reality and quickly course of excessive volumes of transactions— giving us confidence that we are able to drive our development as a group financial institution and a number one banking-as-a-service supplier.”

Barb MacLean might be sharing extra of Coastal Group Financial institution’s transformation story at this yr’s Databricks Monetary Companies Discussion board in New York on March 6. You too can watch her keynote from the on-demand replay in April.