The CEO of a Norwegian {hardware} startup shared a pitch deck with me that had an uncommon slide: It included the corporate’s capitalization desk — the breakdown of who owns what a part of the corporate. Sometimes, cap tables are shared within the diligence part of investing.

Taking a more in-depth take a look at the desk, one thing considerably amiss:

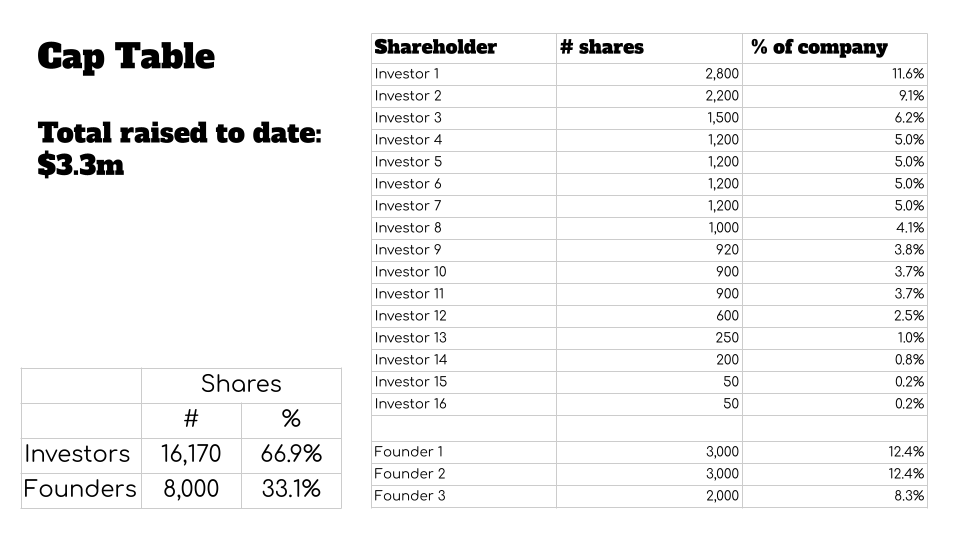

This cover desk is a reproduced, correct illustration of the cap desk that was within the deck. It’s been simplified and redacted to take away the names of the traders. Picture Credit: Haje Kamps/TechCrunch

The issue right here is that the corporate has given up greater than two-thirds of its fairness to lift $3.3 million. With the corporate beginning a $5 million fundraising spherical, that represents a severe hurdle.

TechCrunch spoke to plenty of Silicon Valley traders, posing the hypothetical of whether or not they would put money into a founder who introduced a cap desk with related dynamics because the one proven above. What we realized is that the cap desk because it stands right this moment basically makes the corporate uninvestable, however that there’s nonetheless hope.

Why is that this such an enormous drawback?

In much less refined startup ecosystems, traders may be tempted to make short-sighted choices, equivalent to attempting to take as a lot as 30% of an organization’s fairness in a comparatively small funding spherical. In the event you’re not aware of how startups work in the long term, that may look like a smart objective: Isn’t it an investor’s job to get as a lot as they’ll for the cash they invested? Maybe, sure, however hidden inside that dynamic is a de facto poison tablet that may restrict how giant a startup can probably get. In some unspecified time in the future, an organization’s founders have so little fairness left, that the associated fee/profit evaluation of the grueling death-march that’s working a startup begins shifting in opposition to them persevering with to provide it their all

“This cover desk has one large pink flag: The investor base owns twice as a lot because the three founders mixed do,” mentioned Leslie Feinzaig, basic accomplice at Graham & Walker. “I need founders to have a number of pores and skin within the sport. One of the best founders have a really excessive incomes potential — I need it to be unquestionably value their time to maintain going for a few years after my funding in them … I need the incentives to be utterly aligned from the get go.”

Feinzaig mentioned that this firm, because it stands, is “basically uninvestable,” except a brand new lead is available in and fixes the cap desk. In fact, that, in itself, is a high-risk transfer that’s going to take a number of time, power, cash and legal professionals.

“Fixing the cap desk would imply cramming down present traders and returning possession to the founders,” Fainzaig mentioned. “That’s an aggressive transfer, and never many new traders are going to be keen to go to these lengths. If that is the subsequent OpenAI, they’ve a good shot at discovering a lead who will assist clear this up. However on the seed stage, it’s brutally arduous to face out so clearly, not to mention within the present VC market.”

With unmotivated founders, the corporate would probably exit ahead of it may need in any other case. For these of us who dwell and breathe enterprise capital enterprise fashions, that’s a foul signal: It results in mediocre outcomes for startup founders, which limits the quantity of angel investing they are going to be capable of do, taking the entry-level funding out of the startup ecosystem.

Such an early exit would additionally restrict potential upsides for the VCs. An organization that exits later at a far greater valuation will increase the possibility of an enormous, 100x fund-returning consequence from a single funding. That, in flip, signifies that the restricted companions (i.e. the oldsters who put money into VC corporations) see decreased returns. Over time, the LPs will get tired of that; the entire level of VC as an asset class is extremely excessive danger, for the potential of ludicrously good returns. When the LPs go elsewhere for his or her high-risk investments, your complete startup ecosystem collapses because of lack of funds.

There’s a potential answer

“We positively need to attempt to hold seed and Collection A cap tables trying ‘regular,’” Hunter Stroll, basic accomplice at Homebrew, instructed TechCrunch. “Sometimes traders personal a minority of the corporate in complete, the founders nonetheless have wholesome possession, which they’re vesting into, and the corporate/workforce/pool has the remainder of the widespread [stock].”

I requested the CEO and founding father of the {hardware} firm in query how the corporate obtained itself into this mess. He requested to stay nameless in order to not endanger the corporate or go away his traders in a foul spot. He explains that the workforce had a bunch of large-company expertise however lacked expertise within the startup world. Which means they didn’t know the way a lot work it could take to get the product to market. Internally, he mentioned that the corporate accepted the phrases “only for this spherical,” and can pursue the next valuation for the subsequent spherical. In fact, as the corporate stored working into delays and points, the traders ran a tough discount, and going through the selection of working out of cash or taking a foul deal, the corporate determined to take the unhealthy deal.

The CEO says the corporate is constructing an answer for an issue skilled by 1.7 billion folks, and that the corporate has a novel, patent-pending product that it has been efficiently testing for six months. On the face of it, it seems to be like an organization with multi-billion-dollar potential.

The present plan is for the corporate to lift the present $5 million spherical, after which make an try at correcting its cap desk later. That’s a good suggestion in idea, however the startup has ambitions of elevating from worldwide traders who’re going to have some opinions on the cap desk itself. And which will elevate questions in regards to the founders themselves.

Cleansing up a cap desk

“Conditions like these which deserve ‘clear up’ definitely aren’t automated ‘passes’ however they require the corporate and cap desk to be snug with some restructuring so as to repair the motivation construction alongside the financing,” Stroll mentioned. “If we really feel prefer it’s going to be close to inconceivable to reconcile (even when we play the ‘unhealthy man’ on behalf of the founders), we’ll typically advise the CEO to resolve it earlier than elevating extra capital.”

Mary Grove from Bread & Butter Ventures agrees that it’s a pink flag if founders personal so little of their firm on the seed stage — and specifically that the traders personal the opposite 66%, somewhat than a few of the fairness having gone to key hires.

“We’d need to perceive the explanations behind why the corporate has taken such dilution this early. Is it as a result of they’re based mostly in a geography with restricted entry to capital and a few early traders — both not skilled with VC or unhealthy actors — took benefit,” Grove instructed TechCrunch. “Or is there an underlying motive with the enterprise that made it actually arduous to lift capital (have a look by way of income development/churn, did the corporate make a serious pivot that made it basically begin from scratch, was there some litigation or different problem)? Relying on the explanation, we may get behind discovering a path ahead if the enterprise and workforce met our filter for funding and we imagine it’s the proper partnership.”

Grove mentioned that Bread and Butter ventures likes to see the founders personal a mixed 50-75% at this stage of the corporate — the inverse of what we see in our above replica — citing that this ensures alignment of curiosity and that founders are given recognition and incentive to construct for the gap forward for a venture-backed firm. She means that her agency may need a time period sheet that features corrective measures.

“We might request that the founders obtain extra possibility grants to convey their possession as much as the mixed 50-75% previous to us main or investing within the new spherical,” Grove says, however she factors out the problem on this: “This does imply present traders on the cap desk would additionally share within the total dilution to make this reset occur, so if everyone seems to be onboard with the plan, we’d hope to be all aligned on the trail ahead to help the founders and guarantee they’ve possession to execute their massive imaginative and prescient and to take the corporate by way of to an enormous exit.”

Finally, the general danger image will depend on the specifics of the corporate, and will depend on how capital intensive the enterprise will probably be sooner or later. If another elevate may get the corporate to cash-flow impartial, with wholesome natural development from there, that’s one factor. If this can be a kind of enterprise that can proceed to be capital-intensive and would require a number of rounds of great funding, that modifications the chance profile additional.

Rewinding the alternatives

The CEO instructed me that the corporate’s first investor was a big impartial analysis group in Norway, which frequently spins out its personal firms based mostly on expertise improvements it has developed. Within the case of this firm, nevertheless, it made an exterior funding at what the founder now describes as “below-market phrases.” The CEO additionally talked about that present traders on its board steered elevating cash at low valuations. As we speak, he harbors regrets, understanding that the alternatives may put the corporate’s long-term success in jeopardy. He mentioned he suspected that VCs wouldn’t suppose his firm was investable, and ensuring that this difficulty was entrance and heart for future traders is why he put the cap desk as a slide within the slide deck within the first place.

The issue will not be remoted to this one founder. In lots of growing startup ecosystems — equivalent to Norway’s — good recommendation may be arduous to come back by, and the “norms” are typically determined by individuals who don’t all the time perceive how the enterprise mannequin seems to be elsewhere.

“I don’t need to alienate my traders; they do a number of good issues as properly,” the CEO mentioned.

Stroll says that unhealthy actors are, sadly, not as uncommon as he’d like, and that Homebrew typically come throughout conditions the place an incubator or accelerator owns 10% or extra on “exploitive phrases,” or the place higher than 50% of the corporate already bought to traders, or the place a big portion of the shares are allotted to completely vested founders who may now not be with the corporate.

The upshot might be if non-local traders need to put money into early-stage firms in growing ecosystems, they’ve an unimaginable alternative: By providing extra cheap phrases to promising early-stage startups than the native traders are keen to provide, they’ll decide one of the best investments and go away the native traders to struggle over the scraps. However the apparent draw back is that this might signify an amazing monetary drain from the ecosystem: As a substitute of maintaining the cash within the nation, the wealth (and, probably, the expertise) goes abroad, which is exactly the form of factor the native ecosystem is attempting to keep away from.

==

If in case you have information suggestions or data for Haje, you may share it with him over e-mail or Sign