KX and Databricks have partnered to develop time sequence analytics options for the capital markets sector to help many use circumstances together with quant analysis and temporal trade-data analytics.

So far, information science and analytics programming languages similar to SQL, Python or R for temporal or time-series analytics have been each cumbersome and time-intensive. Regardless of its recognition and highly effective question language, SQL has limitations when interrogating time-series information about order (e.g., time-based joins) and prior states. Python and R, and even Spark, require pages of code to carry out temporal analytics. These limitations are additional compounded by the challenges of high-dimensional information related to time-series evaluation.

For hedge funds or institutional buyers specifically, this collaboration combines the specialised sequence time-series information dealing with capabilities of KX with the great compute and machine studying frameworks accessible on Databricks. By specializing in time-series information, this partnership units a brand new normal in quantitative and information science analysis, modeling, and buying and selling evaluation for the monetary business.

Information Ecosystem and Integration Advantages

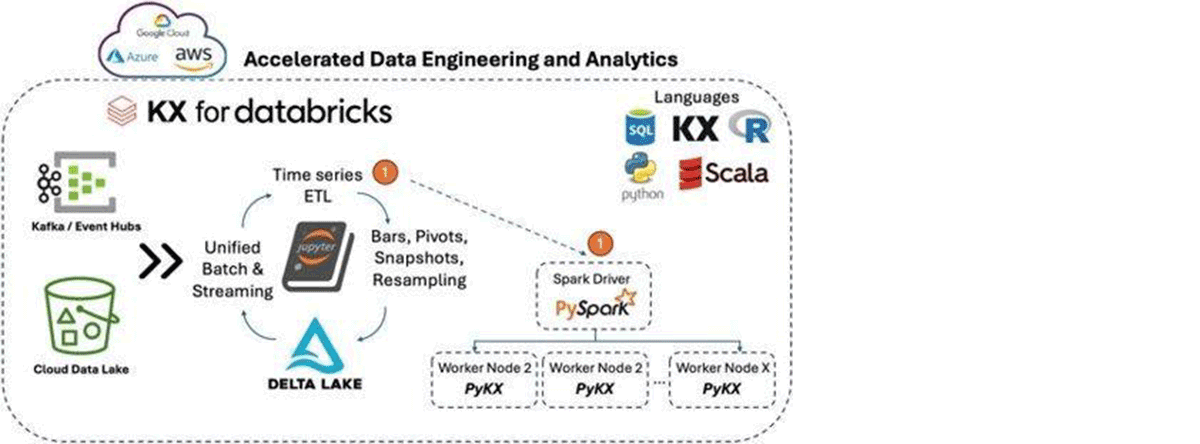

The mixed strengths of KX and Databricks provide important advantages, notably in information administration. Delta Lake gives a cheap, safe, and dependable technique of managing time-series information supported by unified governance capabilities. The huge quantity of information managed by purchasers leveraging Databricks is rising exponentially, and Databricks’s partnerships with the key information suppliers will allow entry to the information with ease, natively on the cloud, by means of mechanisms similar to delta sharing.

It fosters collaboration throughout departments by enabling entry to a unified information ecosystem, the place a single copy of information is utilized by a number of groups. Customers get to faucet into scalable and price-performant compute on a single model of information, managed by Unity Catalog, the Databricks governance framework, for cross-domain functions and information pipelines, utilizing a developer-friendly platform for instantaneous quantitative and buying and selling workloads.

Integration Dynamics

The merging of PyKX, KX’s Python interoperability interface for the extremely regarded kdb+ time-series database, with Databricks provides capital markets companies a robust platform for performing refined queries and analytics on intensive datasets saved in Delta Lake, eliminating the necessity for extra information storage options and simplifying the analytics workflow.

PyKX seamlessly installs through Python Bundle Index (PyPI) to be built-in into present Databricks notebooks to deal with more and more bigger datasets with pace and class and might natively execute on a single driver node inside Databricks, delivering spectacular efficiency with sizable in-memory datasets.

By specializing in time-series information evaluation, the partnership allows an in depth exploration of economic information over time, unlocking essential insights for strategic and within the second decision-making.

Monetary Providers Use Circumstances

Except for time-series evaluation, capital markets can leverage KX and Databricks to be used circumstances that embrace enhanced technique backtesting, market surveillance, counterparty threat evaluation, and high-volume order ebook evaluation. Asset administration companies can carry out predictive portfolio evaluation and threat administration methods. Inside banking, KX’s software throughout fraud detection and prevention may help clients to carry out fine-tooth-comb evaluation throughout transactions, orders and market information to pinpoint nefarious buying and selling behaviors indicative of fraud by using the best-in-class temporal analytics of kdb+ alongside Databricks’ machine studying frameworks to refine fraud detection fashions at low latency constantly. This integration equips banks to successfully fight fraud, guaranteeing operational safety and defending buyer belongings.

Past banking and capital markets, the insurance coverage and funds sectors may profit from Delta Lake’s transactional capabilities alongside KX’s superior time-series analytics to enhance use circumstances similar to pricing, claims and premium forecasting, and fraud detection and mitigation.

Trying Ahead (AI and ML Use Circumstances)

The KX and Databricks integration enhances Databricks’ capabilities in time-series information evaluation. It paves the best way for additional developments in our mutual clients’ machine studying (ML) interoperability, permitting them to advance present investments seamlessly utilizing KX on Databricks. Collectively, we’re working in the direction of integrating ML algorithms that may be utilized to the huge datasets managed throughout the Databricks Lakehouse alongside KX and kdb+ to uncover extra profound and extra well timed insights, predict traits, and enhance mission-critical decision-making. This strategy leverages the power of kdb+ in dealing with large-scale time-series information and analytics, with the superior information engineering and ML/AI capabilities of Databricks, offering a complete analytics platform for the subsequent technology of capital markets.

Moreover, the combination provides seamless entry to conventional KX options deployed on-premises or within the cloud. This ensures that companies can leverage the complete spectrum of KX’s analytical capabilities with the flexibleness and scalability of Databricks’ cloud-native platform for enhanced Information Science/ML and notebooking connectivity right into a KX buyer’s property. By enabling seamless entry to those highly effective instruments, the partnership ensures that capital markets professionals have a strong set of options for information analytics, able to assembly a variety of analytical wants from historic information evaluation up the stack to low-latency and real-time streaming insights.

This integration merges KX’s specialised capabilities with Databricks’ scalable analytics platform, enabling Capital Markets companies to navigate right this moment’s evolving data-driven panorama extra successfully.

Connor Gervin, Lead Architect and Jack Kiernan, Head of Gross sales, Americas at KX will probably be sharing extra about KX’s collaboration with Databricks at this yr’s Databricks Monetary Providers Discussion board in New York on March 6. You can even watch the KX demo from the on-demand replay in April.