Astek Diagnostics closed a $2 million spherical for its urine diagnostics system, even supposing elevating cash for medtech isn’t for the faint of coronary heart. The corporate’s deck has some great things in it and could possibly be a deep supply for issues we will study from, too.

We’re searching for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

Astek Diagnostics has a reasonably beefy 22-slide deck that splits numerous the narrative over a number of slides. In some elements, the deck is complete and spectacular, but it surely additionally comes throughout as fairly defensive and barely dated, although this fundraising spherical closed not too long ago. Among the slides have been flippantly redacted.

- Cowl slide

- Imaginative and prescient slide

- Platform slide

- Strategy slide (Half 1)

- Strategy slide (Half 2)

- Present focus slide (Half 1)

- Present focus slide (Half 2)

- Resolution slide

- The way it works slide (Half 1)

- The way it works slide (Half 2)

- Expertise slide

- Group slide

- Advisory board slide

- Expertise validation testing

- IP overview slide

- Firm validation slide

- Firm timeline slide

- Funding phrases slide

- Business and Exit technique

- Comparable transactions slide

- Government abstract

- Closing slide

Three issues to like about Astek Diagnostics’ pitch deck

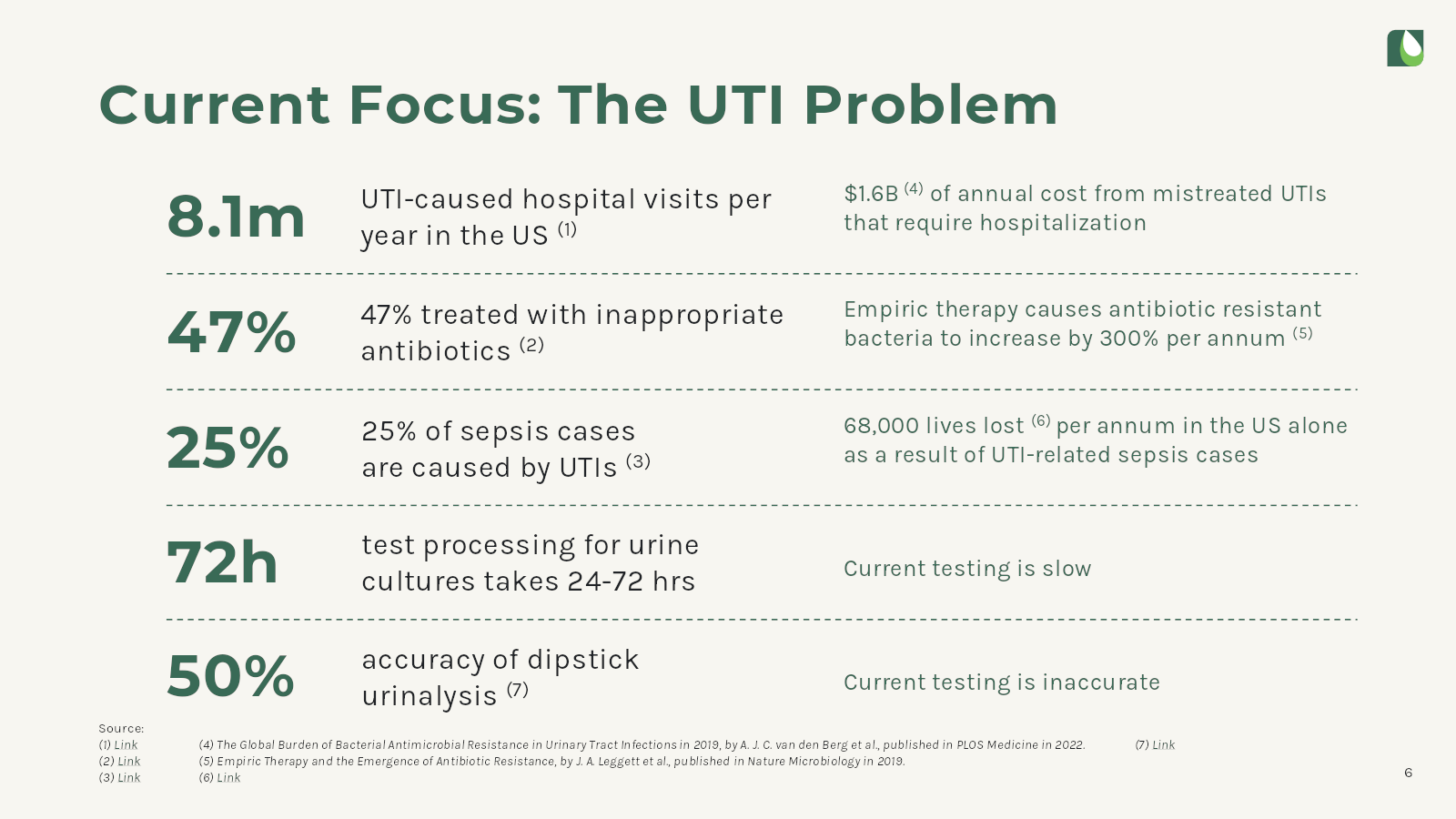

The place the AD pitch deck is sweet, it’s nice: complete, well-researched and well-designed. Slide 6 — the issue assertion — is a superb instance of all three coming into play.

A complete drawback assertion

[Slide 6] An important, complete drawback assertion. Picture Credit: Astek Diagnostics

Explaining the issue in a pitch deck is essential as a result of it lays the inspiration for individuals to know the need and relevance of your startup. This part ought to captivate the viewers by highlighting a spot or inefficiency out there that the corporate goals to handle. It units the context for the complete presentation, permitting buyers to know the magnitude and urgency of the difficulty at hand. Higher nonetheless, explaining the issue successfully helps to validate the market demand for a services or products.

On this slide, Astek takes the chance to current information and insights that again up its declare, thereby reinforcing the potential for development and success. This part is a startup’s first step in constructing a compelling narrative that aligns its mission with the pursuits and funding targets of would-be buyers.

On this slide, Astek paints an impactful image: large quantities of hospitalizations, pointless remedies, issues with pace and accuracy. Resolve these issues, this slide suggests, and nearly 70,000 lives per 12 months might be saved.

One other factor this slide does effectively. It describes the issue, however what’s actually going to make buyers lean ahead is the immense proportion of the issue: 8.1 million hospitalizations signifies that there’s a really formidable market measurement at play right here.

Strong defendability

In biotech, an organization is just as worthwhile as the power to guard it, and having an ideal moat is a key a part of constructing a startup for the ages. The truth that the corporate is considering IP safety is reassuring, though I did have some questions on what every of those really imply.

[Slide 15] The authorized moat round Astek is off to a great begin. Picture Credit: Astek Diagnostics

One query I’ve right here is why the Check Algorithm patent is proven with a publication quantity slightly than the patent quantity; the patent (US11,788,962) was granted in October 2023. The second IP entry — the Fluidic Cartridge patent — is marked as pending, but it surely’s obtainable to the general public.

The third one had me flummoxed, so I checked with the workforce at Run8 Patent Group. They defined that that quantity is neither a patent nor a publication quantity: it’s a provisional patent quantity. We weren’t capable of inform whether or not the patent was transformed to a non-provisional patent, however on the very least, the terminology is complicated right here.

The ultimate entry on this listing — for a Speedy Cartridge Modification — can also be complicated. It seems that’s a legislation agency docket quantity, which isn’t a lot of an IP safety, and my pleasant patent lawyer pals inform me that merely saying “submitting in progress” could have been clearer and probably a extra sincere description of what’s occurring right here.

Simple to know (however …)

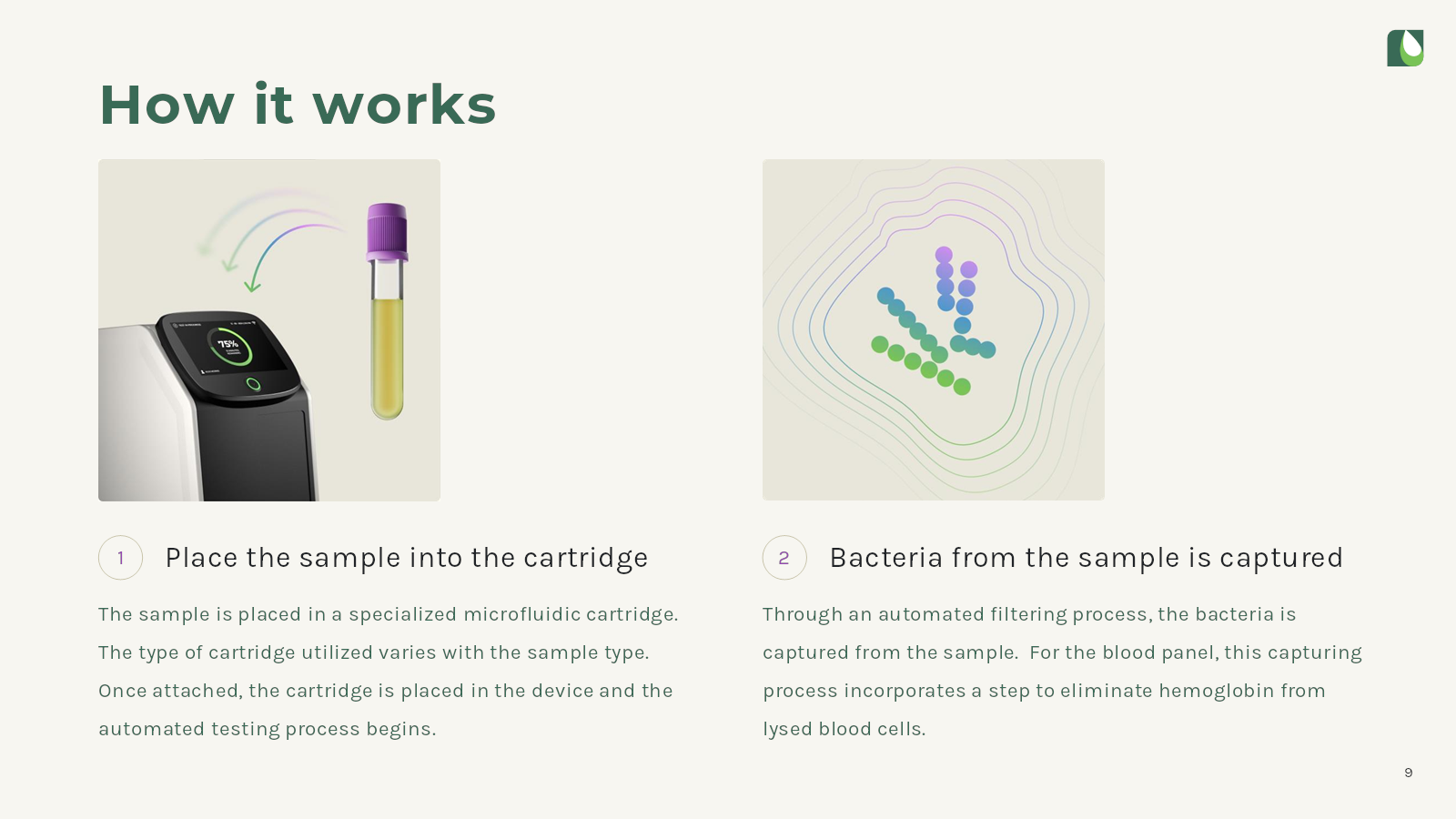

In slides 9 and 10, the corporate makes it very straightforward to know how the system works:

[Slide 9] – The way it works, half 1. Picture Credit: Astek Diagnostics.

[Slide 10] – The way it works, half 2. Picture Credit: Astek Diagnostics.

These two slides do a great job explaining how a consumer would use the product. Insert pattern, micro organism are captured, then examined, then you may learn what the machine discovered. From a gross sales perspective — if I have been a purchaser of certainly one of these machines — that’s an ideal top-level view over how a consumer would use the machine.

However, from the angle of a shopper, that is how I might anticipate a machine like this to work. If I, a non-medically-trained particular person have been to stroll as much as this machine, I believe I may use it. the expectation of consumer expertise is so excessive now, that this isn’t an innovation: That is how issues ought to be. In fact, in medical gadgets, consumer expertise is usually not a excessive precedence, and maybe the benefit of use is a promoting level for the machine, however the best way these slides are projected, I type of go “Sure, and so what?”

What I’d actually like to have seen right here is context. If all the opposite machines are a lot more durable to make use of, inform that story. If the machine is manner sooner, present that comparability. If there’s a main expertise breakthrough, that is what I might be interested in as an investor.

The product slides shouldn’t present easy methods to hit the minimal viable consumer expertise. It’s higher to clarify what it’s concerning the product that makes it particular, defendable and price investing in.

Three issues that Astek Diagnostics may have improved

There have been numerous potential studying alternatives — many greater than I’ve time or area to enter on this pitch deck teardown, however let’s pick some takeaways:

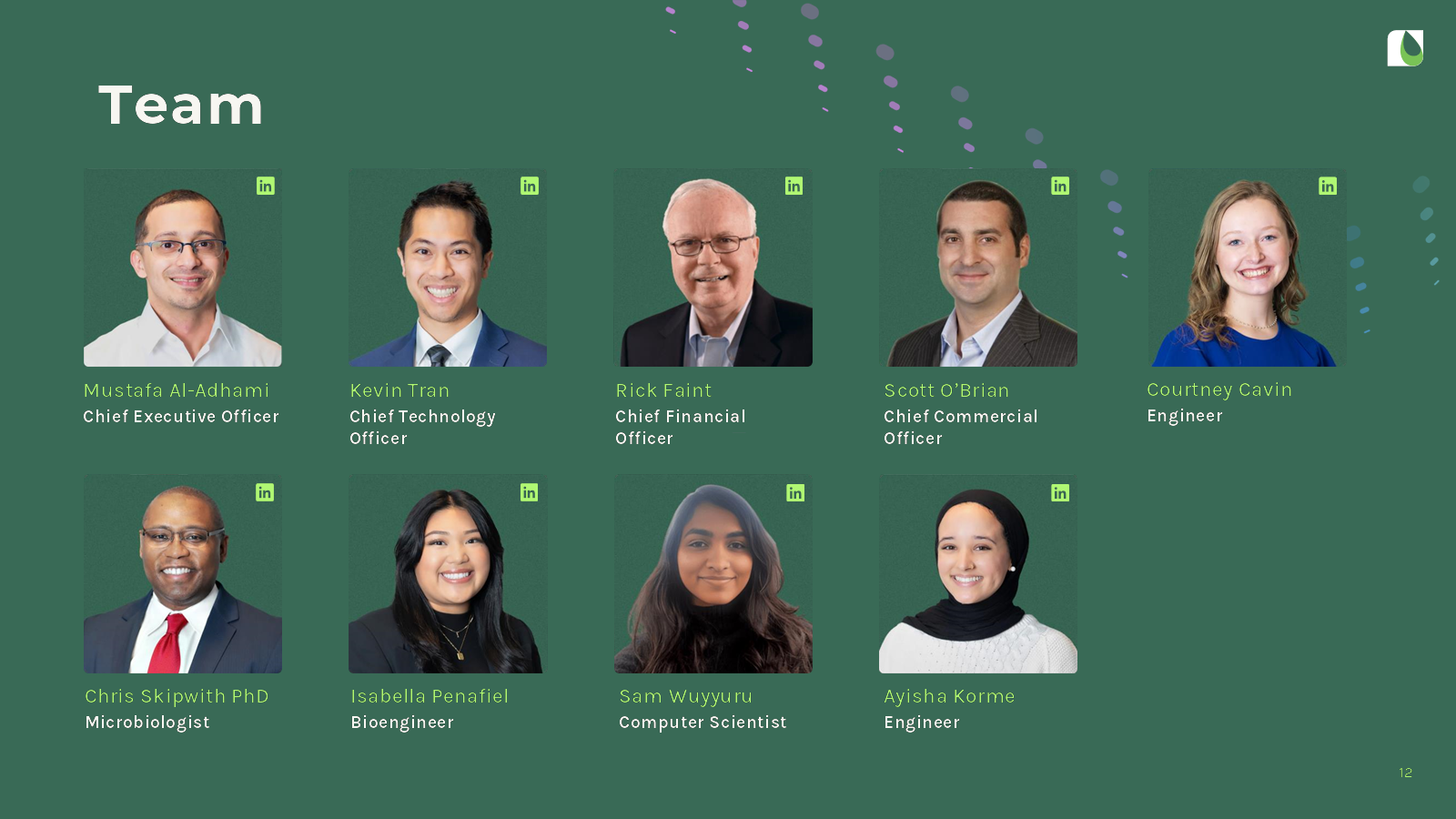

Inform the total workforce story

The workforce slide has each an excessive amount of and too little data on it.

[Slide 12] Teeming with workforce members. Picture Credit: Astek Diagnostics

The aim of a workforce slide is to inform the story of why a workforce is uniquely positioned to construct this particular firm. As an investor, I don’t significantly care about engineers or laptop scientists. The workforce slide is for highlighting the founding workforce and senior management, the oldsters which are trusted to hold this firm by means of the following few rounds of funding and product growth. This slide wants extra context to be helpful.

Astek does get partial credit score for together with LinkedIn hyperlinks to every of the workforce members, however a quick description underneath every title can be simpler.

Because the firm put hyperlinks to the entire workforce’s LinkedIn profiles, I went seeking to see what I may discover — and I discovered some yellow flags. Kevin is listed as a co-founder, not as CTO on LinkedIn. His profile reads that he’s “a flexible full stack developer with a background in Chemical Engineering. My experience lies in creating web-based functions.” In order that’s nice and all, however {hardware} is difficult, and medical gadgets are extraordinarily specialised. Having a CTO that appears to don’t have any startup or {hardware} expertise may trigger buyers to ask some questions.

Rick is listed as the corporate’s CFO — it’s complicated why an organization elevating $2 million would even want a CFO — however he doesn’t listing Astek Diagnostics on his LinkedIn in any respect.

On the slide, Scott is listed as the corporate’s chief industrial officer — once more, an odd position for a corporation that doesn’t have a product in market but — however he, too, doesn’t have Astek Diagnostic listed on his LinkedIn. On the brilliant aspect, he does seem to have related expertise from Particular Diagnostics because the CCO and as a board member of LEX Diagnostics.

In a nutshell, be sure no matter data you embrace in your slides matches with public data that’s obtainable. If not, prepare for some prickly questions from buyers.

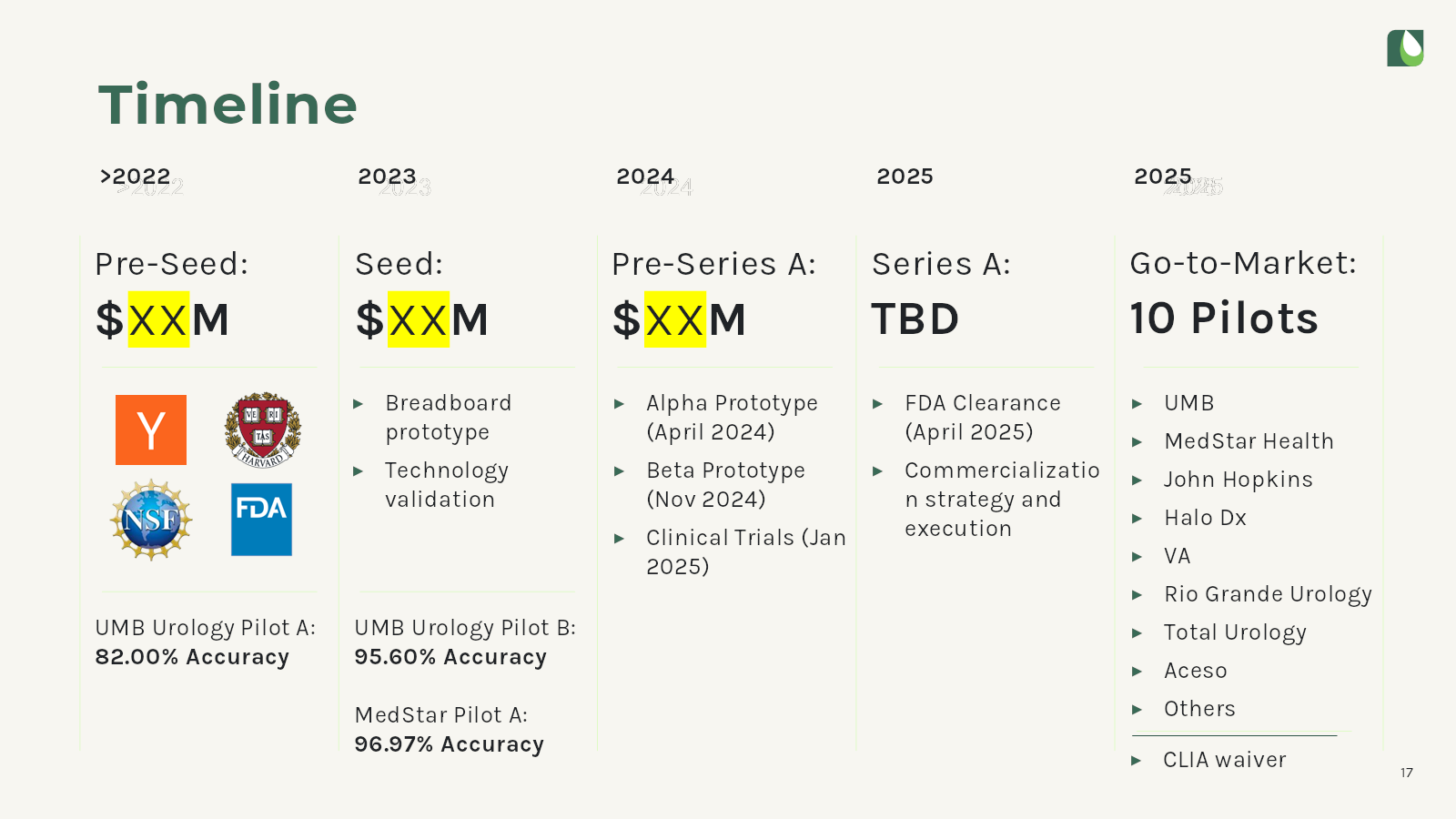

Let’s speak concerning the funding spherical …

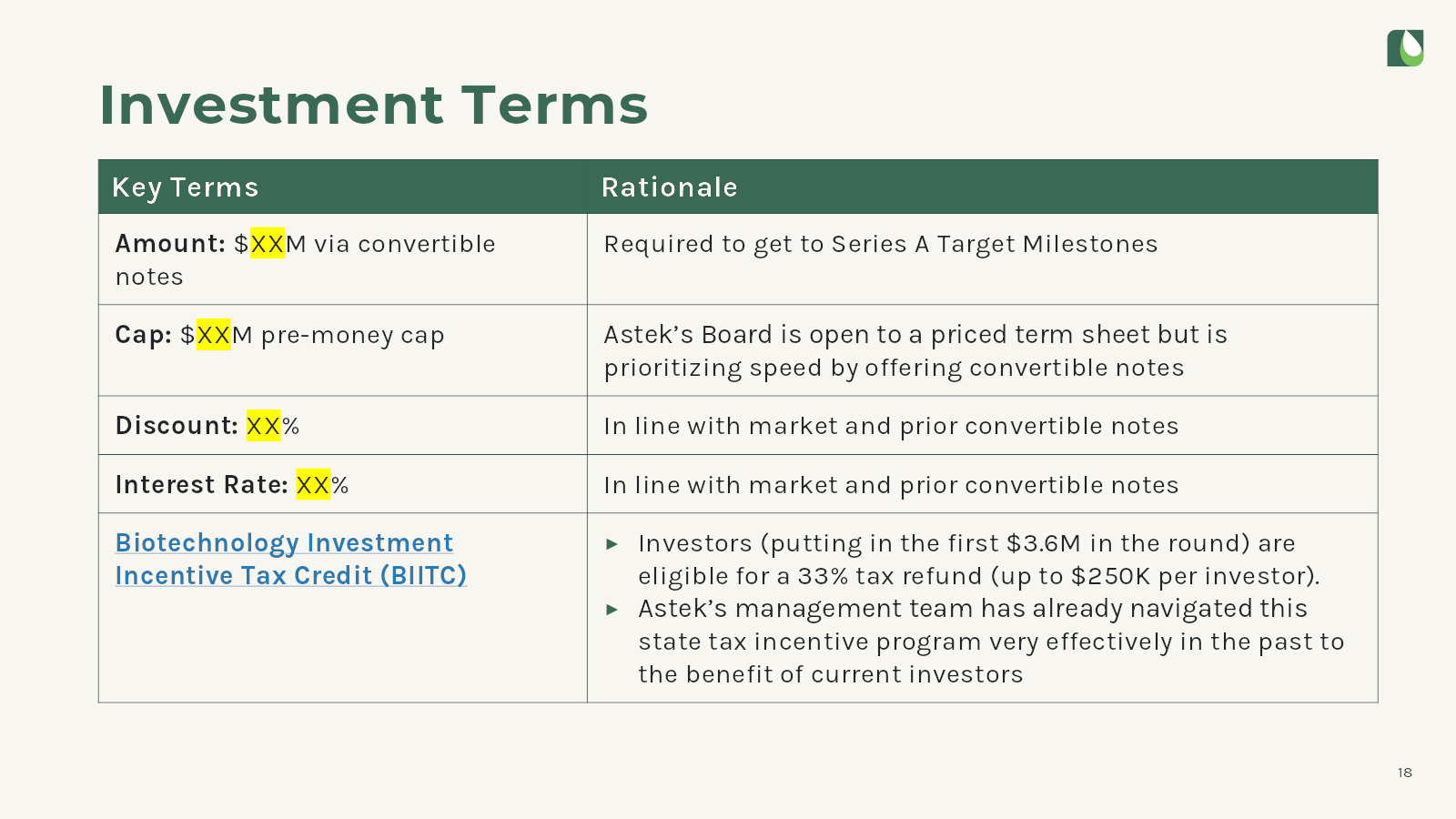

[Slide 17] That’s numerous redacted information. Picture Credit: Astek Diagnostics

The corporate has one thing occurring on its timeline, displaying three rounds of funding, all of them redacted. Placing apart for a second that I’ve by no means heard of a “pre-Collection A” spherical, this, too, raises some flags.

The irony, in fact, is that numerous this data is offered by means of different information sources. When buyers consider whether or not to speak to a startup, they use no matter data obtainable to see the standing of the corporate. On this case, I seemed the corporate up on PitchBook and Crunchbase.

Crunchbase “is aware of” about three rounds of funding. Picture Credit: Crunchbase

Crunchbase tracked a $125k pre-seed spherical, a $256k grant led by the NSF (which seems to be $275k), and a $2 million seed spherical led by Wexford Scitech enterprise fund, which was reported in June 2023.

Pitchbook has a bunch extra data:

PitchBook exhibits an enormous quantity of details about firm financials in its database. Picture Credit: PitchBook

All of that’s to say that I’m not totally positive why the corporate determined to redact this a part of the pitch deck, for the reason that data is so simply gathered from public sources.

What worries me extra, nonetheless, is the following slide:

[Slide 18] This slide is just not solely superfluous, it’s probably a crimson flag. Picture Credit: Astek Diagnostics

There’s numerous issues to fret about on this slide: Elevating an quantity to “get to Collection A goal milestones” helps reply why the corporate wrote “pre-Collection A” within the earlier slides: It’s a bridge spherical. That might imply two issues:

- The corporate wasn’t clear on what it wanted to do to have the ability to increase a Collection A.

- The corporate didn’t hit the targets for its Collection A.

Within the case of the primary choice, that signifies that the founders didn’t have a great roadmap for what it wanted to perform to be able to increase its subsequent spherical. That’s a crimson flag: It’s essential to have a agency set of targets, guaranteeing that the corporate has a transparent path to hitting its milestones and with the ability to increase its subsequent spherical.

The opposite different is that the corporate did have a transparent set of targets, but it surely didn’t hit them. That occurs on a regular basis, and there’s no disgrace in that. Nevertheless, this deck makes the issue worse: It doesn’t clearly define what the corporate thinks the “Collection A goal milestones” are, and nowhere within the deck does it clarify what the milestones are, or what thinks it must do to be able to hit these milestones.

The ultimate crimson flag right here is that the corporate is making an attempt to pre-negotiate the deal: I recognize that the founders have an opinion on what they assume the cap and low cost are, however they don’t get to set these; the lead investor does. It’s attainable, in fact, that this deck was up to date after the corporate already had a term-sheet in hand, but when that isn’t the case, this slide doesn’t come throughout as founders who’re skilled within the fundraising course of.

A lot of the VC business has stopped utilizing convertible notes as of late, utilizing Y Combinator’s post-money SAFEs as a substitute. The additional bizarre factor right here is that Astek Diagnostics is, actually, an Y Combinator alumnus from the accelerator’s S21 batch. It’s complicated why the corporate would go together with one thing aside from the usual funding phrases.

The easy factor can be to simply eliminate this slide altogether. When elevating a certain quantity, the phrases are at all times up for negotiation and can be relying on which manner the VC wind is blowing in that individual second.

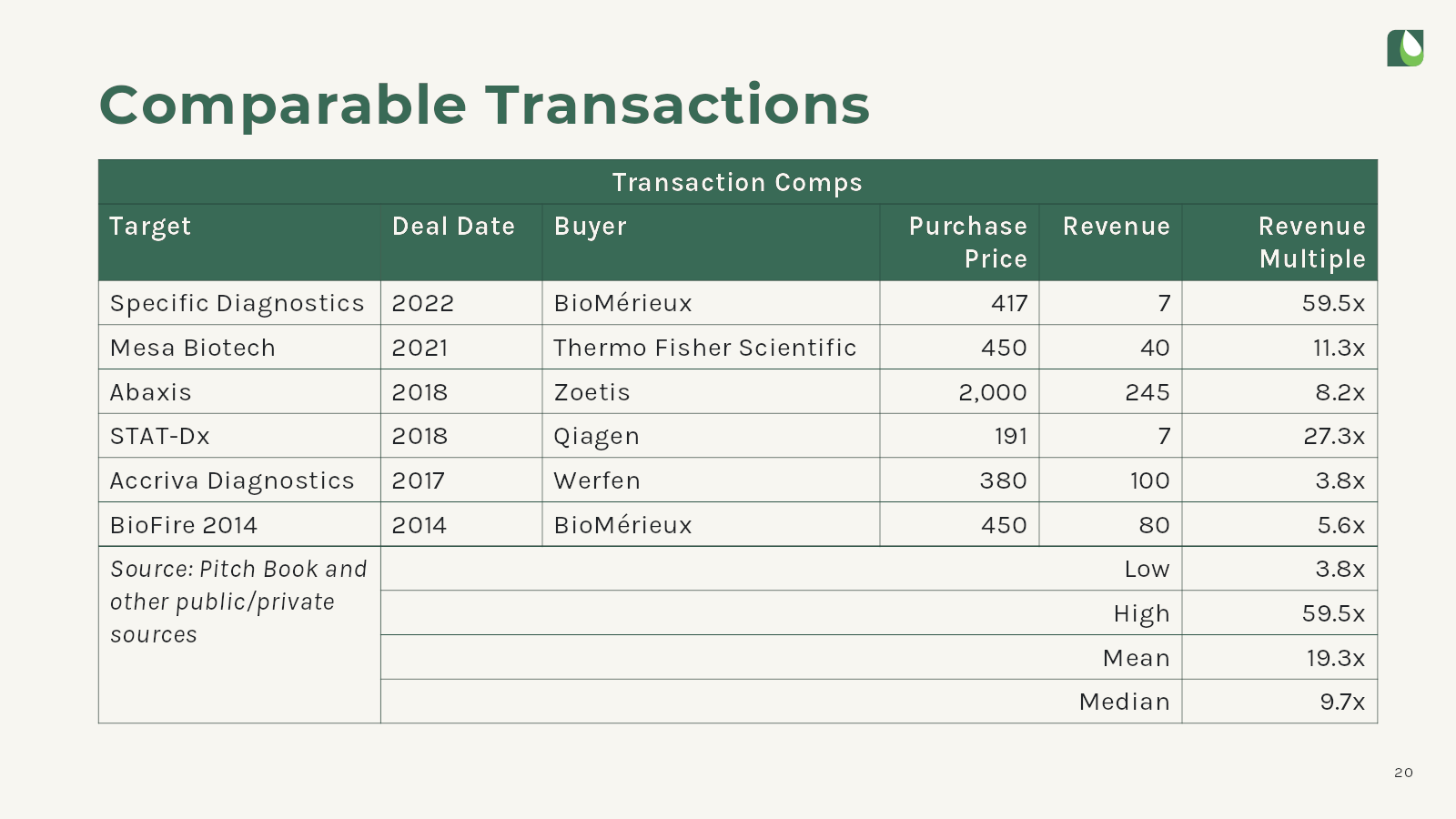

Do away with the ‘exit’ slide

Subtle buyers are aware of comparable exits within the area they’re investing in. A startup’s mission is to construct an especially worthwhile firm. As quickly as founders begin speaking about exits, they’re arguing towards themselves.

Amazingly, Astek Diagnostics included not one, however two exit technique slides:

[Slide 19] Exit technique, half 1. Picture Credit: Astek Diagnostics

[Slide 20] Exit technique, half 2. Picture Credit: Astek Diagnostics

This exit technique slide strikes me as spectacularly defensive, along with sending the mistaken sign. Belief high-quality buyers to know their markets. Founders ought to clarify how they’re going to construct a multi-billion-dollar firm and fear about M&A or IPO one other time.

The total pitch deck

In order for you your individual pitch deck teardown featured on TechCrunch, right here’s extra data. Additionally, take a look at all our Pitch Deck Teardowns all collected in a single useful place for you!