Within the digital age, banking apps have grow to be our monetary lifelines, providing ease and comfort for managing cash like by no means earlier than. But, with the fixed inflow of latest Fintech apps, selecting the best one may be overwhelming. Whether or not you’re opening your first checking account or managing a number of, our information to the highest three iOS banking apps goals to simplify your alternative. Having personally navigated via all three, I’ve discovered that every serves its objective. We’ll delve into every app’s options, pricing, and customer support, providing you a transparent roadmap to deciding on the app that most closely fits your monetary panorama. Let’s uncover the instruments that may redefine your banking expertise.

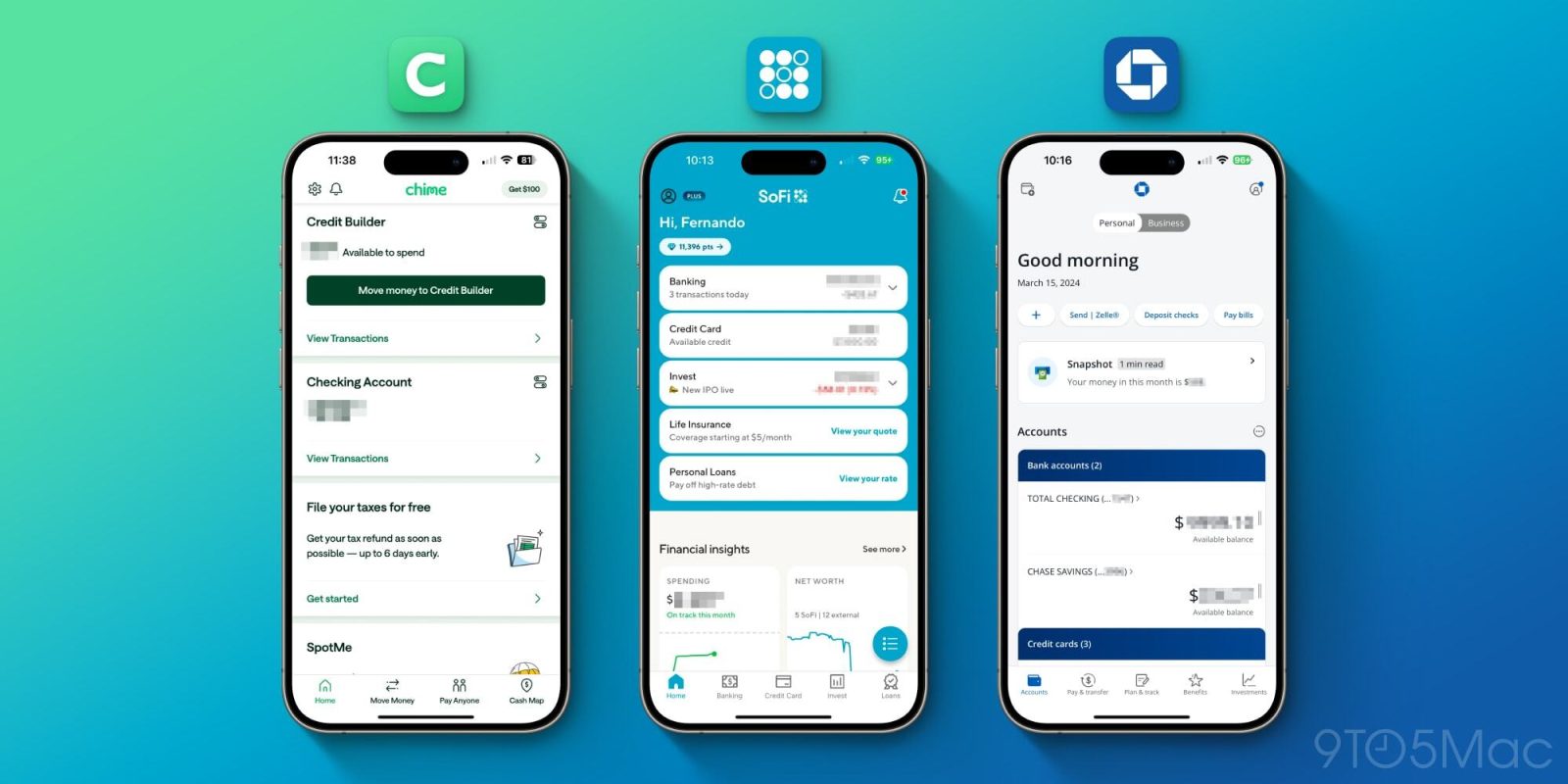

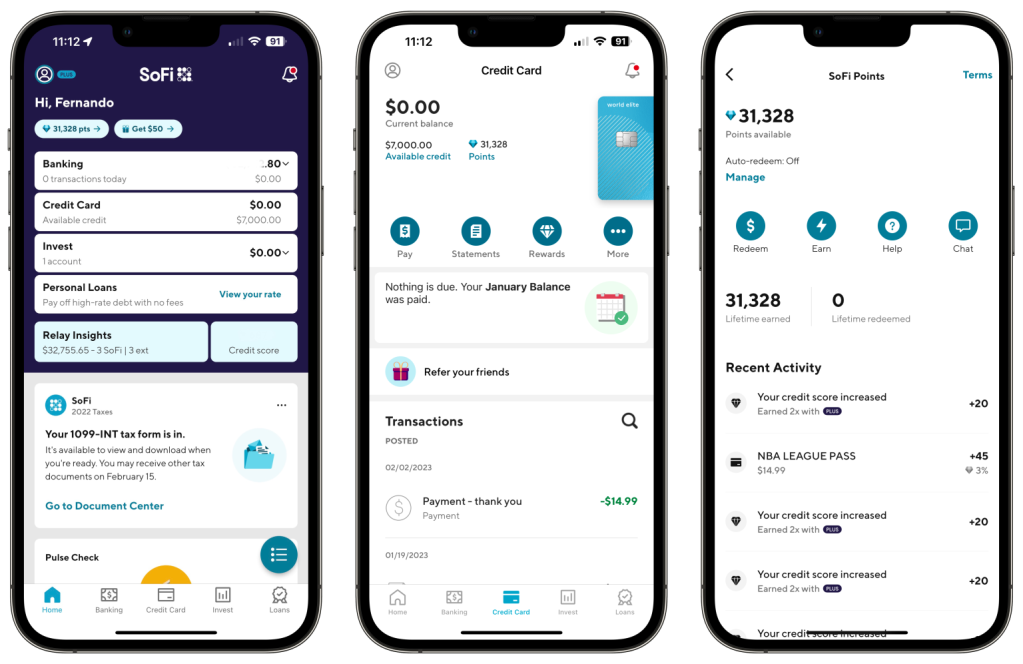

I’ve been with SoFi Financial institution for over two years, and it’s genuinely improved my strategy to managing funds. SoFi stands out by providing an array of companies that cater to just about each facet of economic planning with out the effort of conventional banking charges, the necessity for bodily branches, and the comfort of getting paid two days early.

One of many key sights for me has been SoFi’s compelling suite of merchandise. From private checking accounts with high-yield financial savings boasting an industry-leading 4.6% APY (As of March 2024), to mortgage loans, Roth IRAs, funding choices, bank cards, and even retirement planning, SoFi covers practically each monetary want. Their bank card alone is certainly one of my favourite suggestions, providing you with 3% money again on every part as a zero price card!

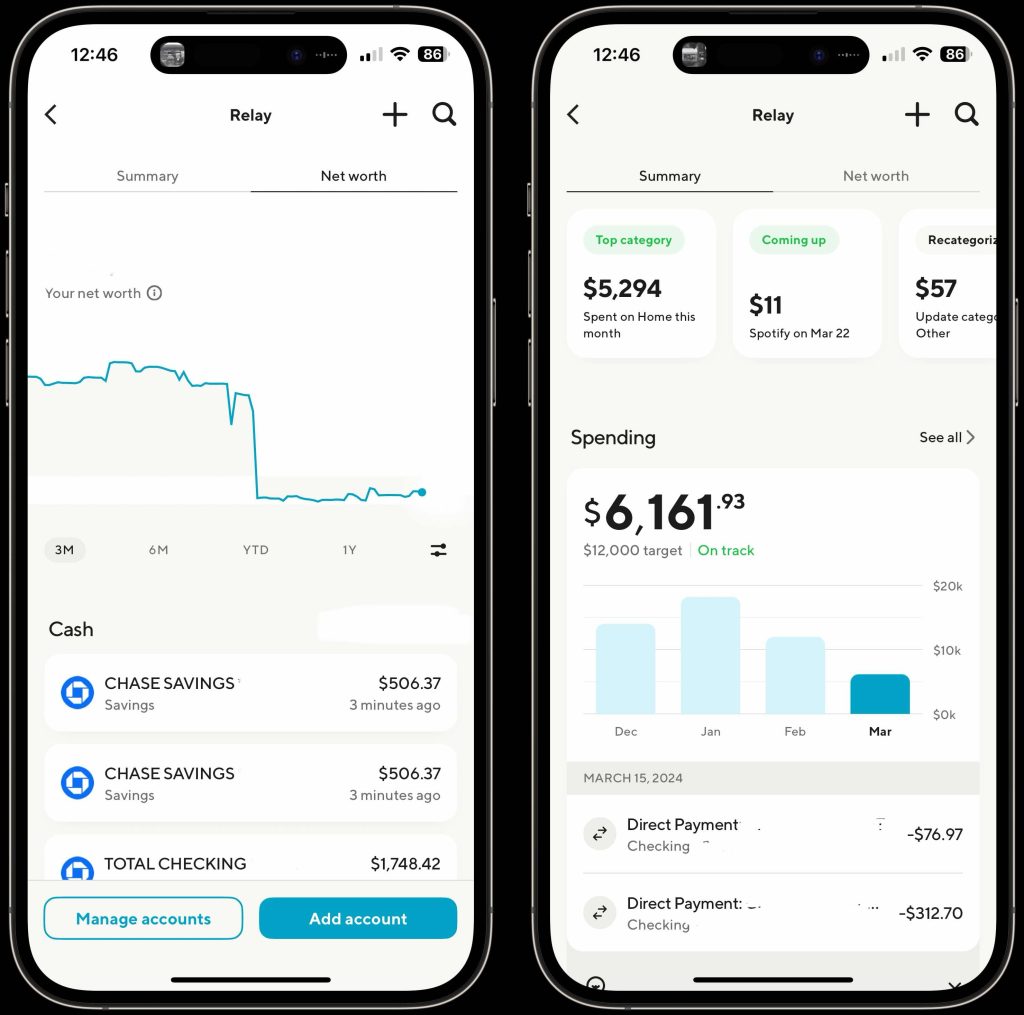

A very revolutionary software that underscores SoFi’s trendy strategy is the SoFi Relay product. This characteristic brilliantly bridges your complete monetary panorama, permitting you to hyperlink exterior financial institution accounts alongside your SoFi accounts. It transforms the app right into a central hub for monitoring bills, earnings, and even your internet value, all up to date in actual time. This degree of oversight is invaluable for anybody seeking to take full management of their monetary well being.

The consumer expertise of the SoFi app itself is a testomony to the financial institution’s dedication to modernity and comfort. Its design is each aesthetically pleasing and functionally superior, guaranteeing that navigating via your monetary knowledge, whether or not it’s checking balances, monitoring investments, or setting financial savings targets, is simple and hassle-free. The emphasis on a seamless and safe consumer interface, mixed with the excellent monetary overview offered by SoFi Relay, locations SoFi Financial institution on the forefront of next-generation banking options.

Professionals

- Characteristic-rich & easy-to-use interface, 4.8 stars on the app retailer

- Excessive-yield financial savings account – 4.6% APY

- Vaults – used to robotically save for sure issues

- ZERO charges, no transaction charges, late charges, overdraft charges, or month-to-month charges of any form

- Paycheck two days early

- Investing platforms

- Retirement planning

- ATM community of 60,000 ATMs

- Cellular test deposit

- Nice, zero-fee, newbie credit score card with 3% money again

- Providing $25 for brand new Signal Ups

- Free Credit score Rating

Cons

- No bodily financial institution branches

- No cashier checks

- Depositing money is feasible however not excellent

Who ought to open a Sofi account?

SoFi is the perfect alternative for banking prospects desperate to elevate their monetary administration. Its iPhone app combines simplicity with intuitive navigation, providing a variety of companies with out the complexity. Superb for customers valuing a top-notch cellular banking expertise over bodily branches, SoFi offers high-yield financial savings and entry to further monetary merchandise like investing and bank cards. This makes SoFi the right platform for anybody seeking to seamlessly combine their banking and monetary development.

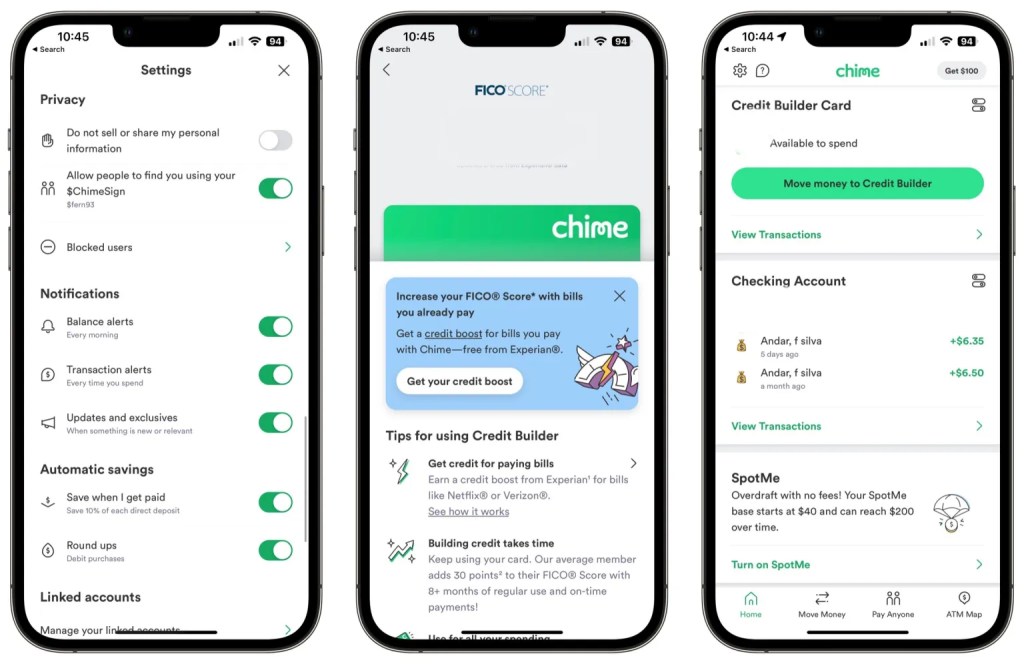

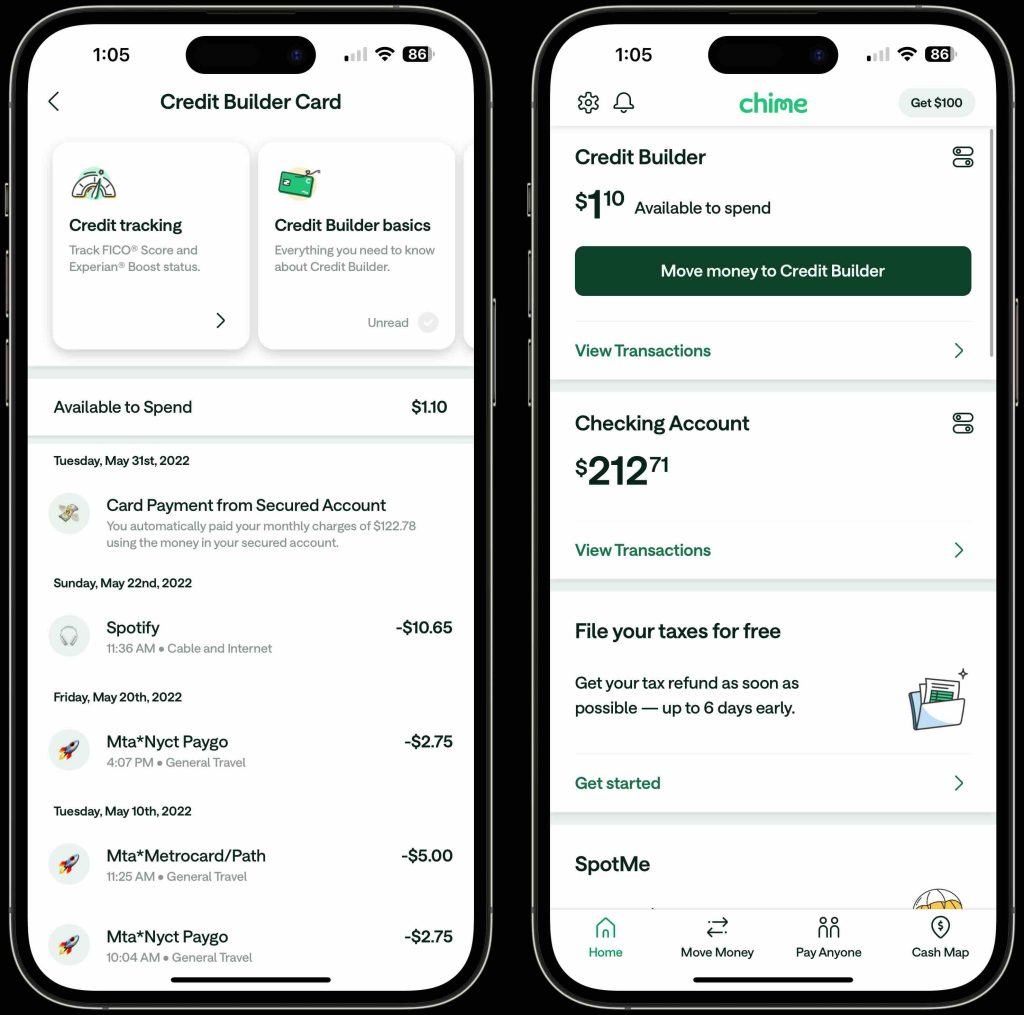

Whereas I’ve moved on from Chime as my go-to financial institution, it holds a cherished spot in my monetary historical past. I used to be with Chime for a strong 5 years earlier than switching to Sofi. Chime was like a crash course in adulting financially—it confirmed me the ropes on saving for the lengthy haul, constructing a strong credit score rating, maintaining on high of my payments, and a complete lot extra.

Chime is a complete no-brainer for freshmen. Signing up is a breeze, and you’ll kiss goodbye to these sneaky hidden charges. The app is tremendous user-friendly, making it a chunk of cake to maintain your funds in test. However the true recreation changer? Chime’s credit score builder card. It’s a genius strategy to increase your credit score with out drowning in debt, because of a pay as you go system that ensures you’re all the time on time with funds. This credit score builder characteristic elevated my credit score rating immensely over the two years I had their Credit score Builder card. Plus, with a ton of free ATMs of their community, you received’t be forking out additional money on charges.

Professionals

- Extraordinarily user-friendly, 4.8 stars on app retailer

- Chime Credit score Builder program – free bank card to assist construct your credit score

- Receives a commission two days early

- ZERO charges, no transaction charges, late charges, overdraft charges, or month-to-month charges of any form

- Spot Me service for overdraft safety as much as $200

- Automated financial savings characteristic – Spherical up financial savings and automatic paycheck division

- Disable misplaced or stolen card

- View card data digitally

- Cellular test deposit

- Free Credit score Rating

Cons

- No bodily branches – in case you are somebody who likes to enter a financial institution, then this isn’t for you

- Cellular test deposit is just out there if enrolled in direct deposit

- Not very product-rich. No funding platform, mortgage merchandise, insurance coverage platform, or mortgage choices

- No cashier checks

Who Chime is for?

I jumped on the Chime bandwagon initially as a result of I used to be all about that slick consumer expertise and their trailblazing strategy to banking with out these pesky charges or the necessity for a bodily financial institution I’d by no means go to. What I used to be after was one thing strong I might run totally from my telephone, the place I might get my paycheck dropped straight in. As Chime upped its recreation, I obtained hooked on their Credit score Builder, which pumped my credit score rating up by a candy 45 factors in only a 12 months by proving I might pay on time, each time.

This can be a golden ticket for anybody recent into the job market who wants a financial institution that’s simple to navigate, offers a leg up in constructing credit score, and lays down the fundamentals of saving with out making your head spin. Additionally, they’re throwing $100 your approach in case you enroll and arrange your direct deposit.

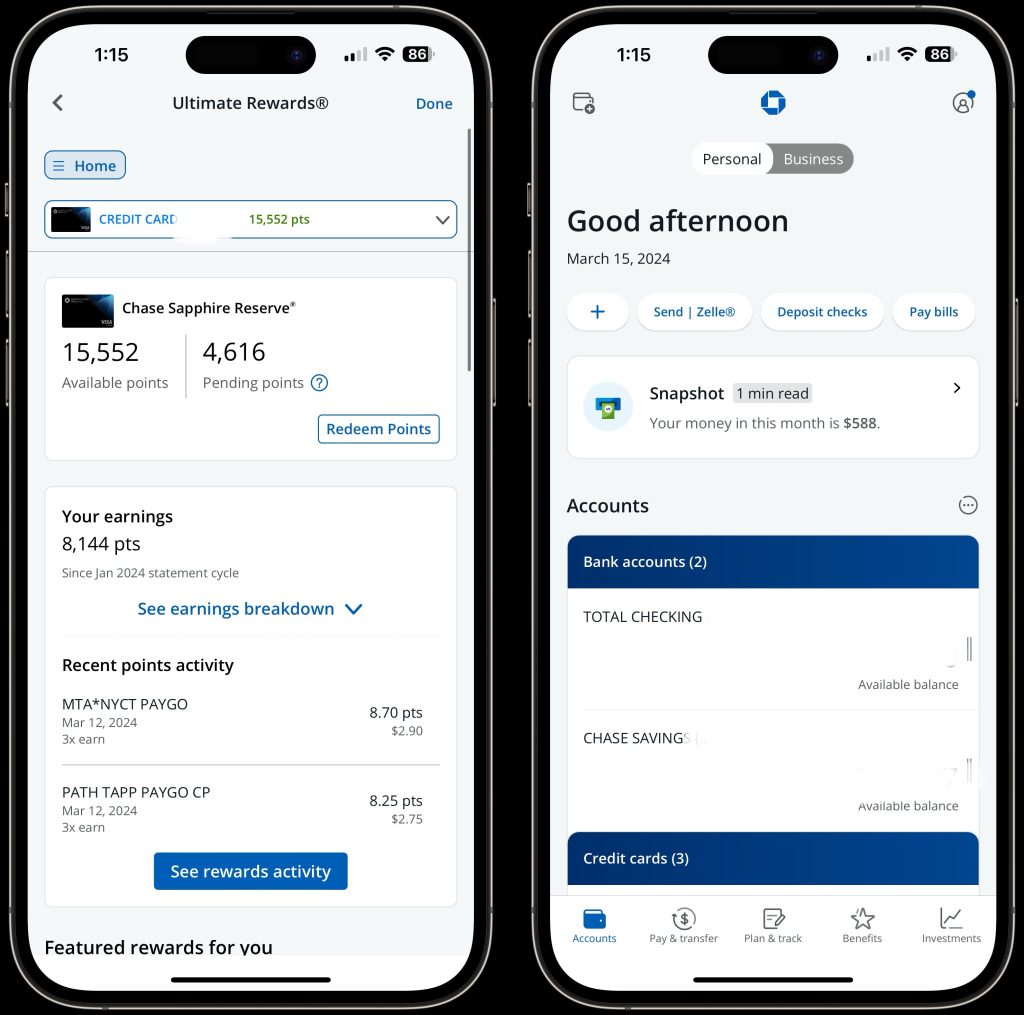

Chase Financial institution is the go-to for individuals who need the reliability of conventional banking with the comfort of a cutting-edge iOS app. It completely blends the consolation of bodily branches with digital innovation, guaranteeing a seamless banking expertise for all prospects. The app itself is a powerhouse, providing simple account administration, distant test deposits, and personalised alerts. This digital software simplifies your monetary life, making it simple to remain on high of your cash with only a few faucets.

Furthermore, Chase doesn’t cease at digital comfort—it’s a complete monetary hub. From mortgages and auto loans to scholar loans, Chase gives each monetary product you may want, making it extremely handy to handle all of your monetary affairs in a single place.

The cherry on high is the Chase Final Rewards program, which I’ve grow to be obsessive about. I’ve been in a position to ebook enterprise class journey from US to Europe free of charge. It turns on a regular basis spending into factors that may be redeemed for luxurious journey, providing a world of free, high-end journey experiences. Right here is the cardboard I exploit for that!

Selecting Chase Financial institution means choosing a banking expertise that mixes custom with expertise and comfort with complete monetary companies, all whereas unlocking the potential for luxurious journey via good spending.

Professionals

- 4.8 stars on app retailer

- Big array of product choices

- Intensive bodily department community

- Chase Final Rewards program

- Big listing of bank card choices to use for

- Credit score rating software

- cellular test deposit

- Disable misplaced or stolen card

- Legacy financial institution

Cons

- Account minimums

- Not free to open account

- No actual HYSA possibility

- Typically too many choices

Who’s Chase for?

Chase is the perfect choose for anybody who desires one of the best of each worlds: a slick, highly-rated iOS app for managing cash on the fly and the strong backup of conventional financial institution branches. It’s spot-on for tech lovers, savvy savers, and globe-trotters, providing a variety of economic companies from fundamental banking to rewarding bank cards. With Chase, you get a banking expertise that’s versatile and rewarding, tailor-made to suit quite a lot of wants and life, all whereas maintaining issues easy and accessible.

Wrap up

It’s clear that you could’t actually go fallacious with any of those cellular banking choices. Chime served me effectively for years earlier than I transitioned to SoFi, which has brilliantly met my evolving monetary wants—be it getting a bank card, planning for retirement, or diving into funding accounts. Switching gears to Chase Financial institution allowed me to maximise my spending and taught me methods to navigate the bank card recreation responsibly. Every of those platforms streamlines your monetary journey, providing unbelievable worth and empowering you to domesticate a optimistic relationship together with your cash. No matter the place you end up on the monetary spectrum, these apps stand able to bolster your cash administration with ease and experience. Let me know who you financial institution with and why and lets talk about within the feedback beneath.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.