When entrepreneur Stephen Chen’s mother started approaching retirement age, she was compelled to borrow cash from Chen — and Chen’s brother — to make ends meet. They wished to assist, however the siblings additionally wished to determine a extra sustainable, long-term resolution that’d assist their mother retire with out having to fret about funds.

Chen tried to get steering from a monetary adviser, however nobody would take his mom as a consumer as a result of her web value wasn’t thought-about excessive sufficient. So Chen began constructing spreadsheets and monetary fashions himself, doing his greatest to determine how his mother may dwell the retirement life-style that she wished.

“Folks like my mother lack the instruments to have a look at their cash holistically and strategically to allow them to make knowledgeable selections, monitor their monetary scenario, perceive which levers to tug and when and make the connection between the alternatives they make as we speak and the long-term ramifications to their plan,” Chen informed TechCrunch. “There’s a confluence of things which will alter the way forward for monetary planning and advising.”

It was after Chen helped his mother decrease her bills, work out when to say Social Safety, resolve when to downsize and take different steps to turn into financially unbiased that Chen realized plenty of different older People had been going through the identical challenges.

So Chen based NewRetirement, a Mill Valley–primarily based firm constructing software program to assist folks create monetary retirement plans. Right now, NewRetirement’s direct-to-consumer merchandise energy monetary planning for 70,000 customers managing near $100 billion in their very own monetary plans, in accordance with Chen.

“Our fashions transcend financial savings and investments, making an allowance for the entire different components in an individual’s life, from dwelling fairness, healthcare prices and taxes to Medicare and Social Safety,” Chen stated. “Each time a person makes a change, we run 1000’s of simulations with a view to assist them optimize their plan … We account for 1000’s of various situations, enabling customers to confidently map out accumulation and decumulation projections with digital steering.”

NewRetirement is Chen’s second startup after Embark, an internet faculty search and admissions software he launched in 1995. And, like Embark, Chen sees NewRetirement as a digital resolution to a transition confronted by thousands and thousands of People.

Chen famous that “120 million People over age 50 maintain 80% of the wealth on this nation, however operating out of cash stays a prime 10 concern, with practically half of People saying they’re anxious about it.”

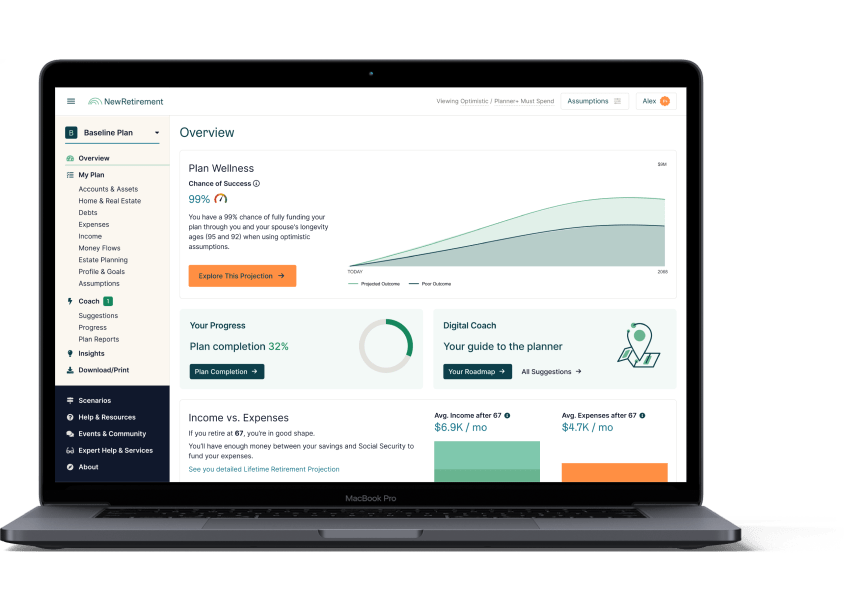

NewRetirement’s platform makes use of predictive modeling and information analytics to assist customers suss out the precise financial savings approaches. Picture Credit: NewRetirement

Certainly, nearly all of People — as many as 65%, per Charles Schwab’s Trendy Wealth Survey 2023 — don’t have any formal monetary plan. And whereas 37% of respondents say that they work with a monetary adviser, two-thirds of People imagine that their monetary planning wants enchancment, in accordance with Northwestern Mutual’s Planning and Progress Examine 2023.

NewRetirement, which started as a shopper providing and in 2021 expanded to the enterprise, expenses $120 per 12 months for entry to a set of instruments, calculators, suggestions and state of affairs comparisons and ~$1,500 per 12 months for check-ins with a licensed monetary planner. As well as, NewRetirement sells a subscription-based personal label model of its instruments aimed toward monetary advisers.

Now, you may marvel, what makes NewRetirement completely different from startups like Retirable, which equally gives an array of retirement planning instruments and entry to asset managers? Chen asserts that NewRetirement is among the few — and maybe solely — monetary planning platforms that serve customers in addition to advisers and workplaces.

“Our core innovation is permitting anybody to create a plan with industrial-strength instruments, enabling advisers to collaborate with the tip person and making this accessible at scale by enterprise companions who deliver it to their prospects,” Chen stated. “As extra monetary providers corporations see their choices like funding administration turn into commoditized, there’s big worth in serving to purchasers and prospects take into consideration their cash holistically. By providing self-directed digital planning to purchasers versus beginning with a human adviser, they will scale and serve any variety of customers, study them, assist them make good selections and place their services extra successfully.”

Chen says that presently about 70% of NewRetirement’s income is enterprise, with the remaining 30% coming from shopper prospects. The platform has 20,000 particular person subscribers and “a number of” wealth administration purchasers, in addition to “a number of” enterprise prospects, together with Nationwide, which lately expanded an present partnership with NewRetirement.

That momentum little doubt helped NewRetirement to cinch its Sequence A funding spherical this month.

The corporate, which has 50 workers, raised $20 million in a tranche that brings its complete raised to $20.8 million, led by Allegis Capital with participation from Nationwide Ventures, Northwestern Mutual Future Ventures, Plug and Play Ventures, Motley Idiot Ventures and others. Chen says that the money infusion will likely be used to increase NewRetirement’s enterprise merchandise, scale up onboarding, speed up R&D efforts and construct capability to fulfill future demand.

“With this new capital, we can have three to 4 years of runway,” Chen stated. “That offers us time to proceed to scale our enterprise partnerships and improve our product. What’s extra, the present downturn is enabling us to herald unbelievable expertise. We have now a robust group in place and can increase headcount additional this 12 months.”