McKinsey predicts that generative AI might add $200-340 billion in annual worth to the banking sector, which might principally come from productiveness will increase. The consultancy says that Gen AI will change the way in which prospects work together with monetary establishments and the way on a regular basis duties are approached.

Do you are feeling like that is an exaggeration? Let’s discover what generative AI can do for the monetary sector. And, as a Gen AI consulting agency, we are going to share our experience on methods to get began with the expertise in your monetary establishment and which challenges to anticipate alongside the way in which.

Influence of generative AI on the monetary sector

First, how does Gen AI differ from synthetic intelligence?

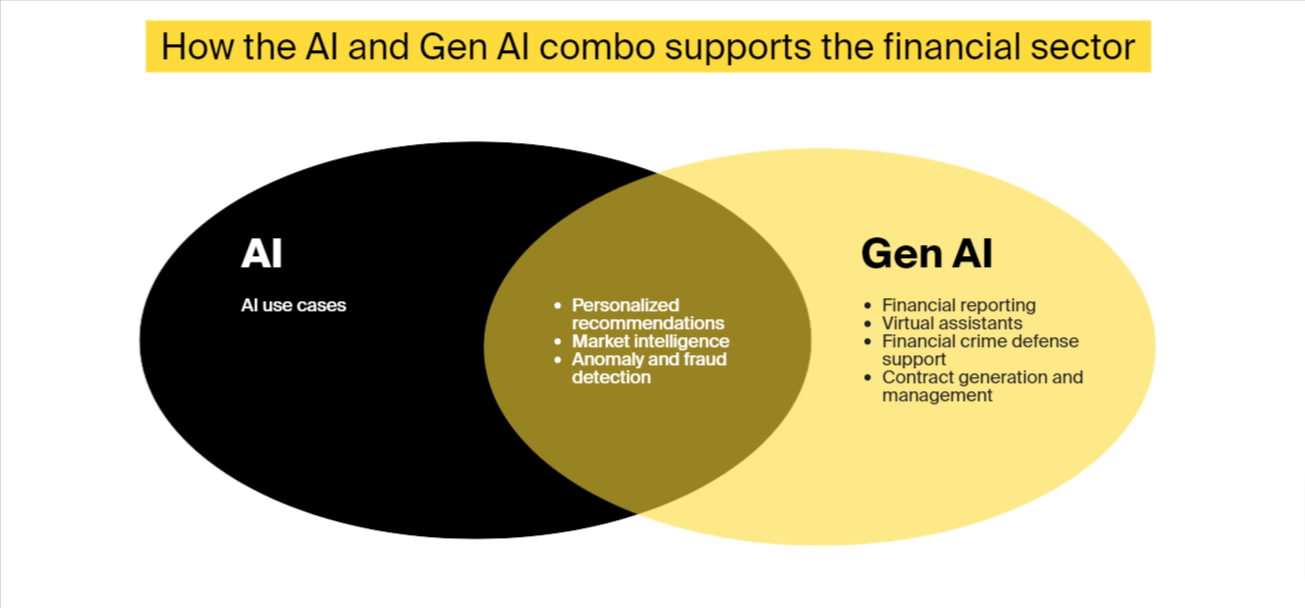

The traditional AI is generally used for classification and prediction duties, whereas Gen AI can ship unique content material that appears like human creation. For instance, a standard synthetic intelligence mannequin can inform you if an object in a picture is a cat; a Gen AI mannequin can generate an image of a cat primarily based on its information base of different cat photos.

Yow will discover extra info on the distinctions between Gen AI and AI on our weblog.

Now, let’s get again to generative AI.

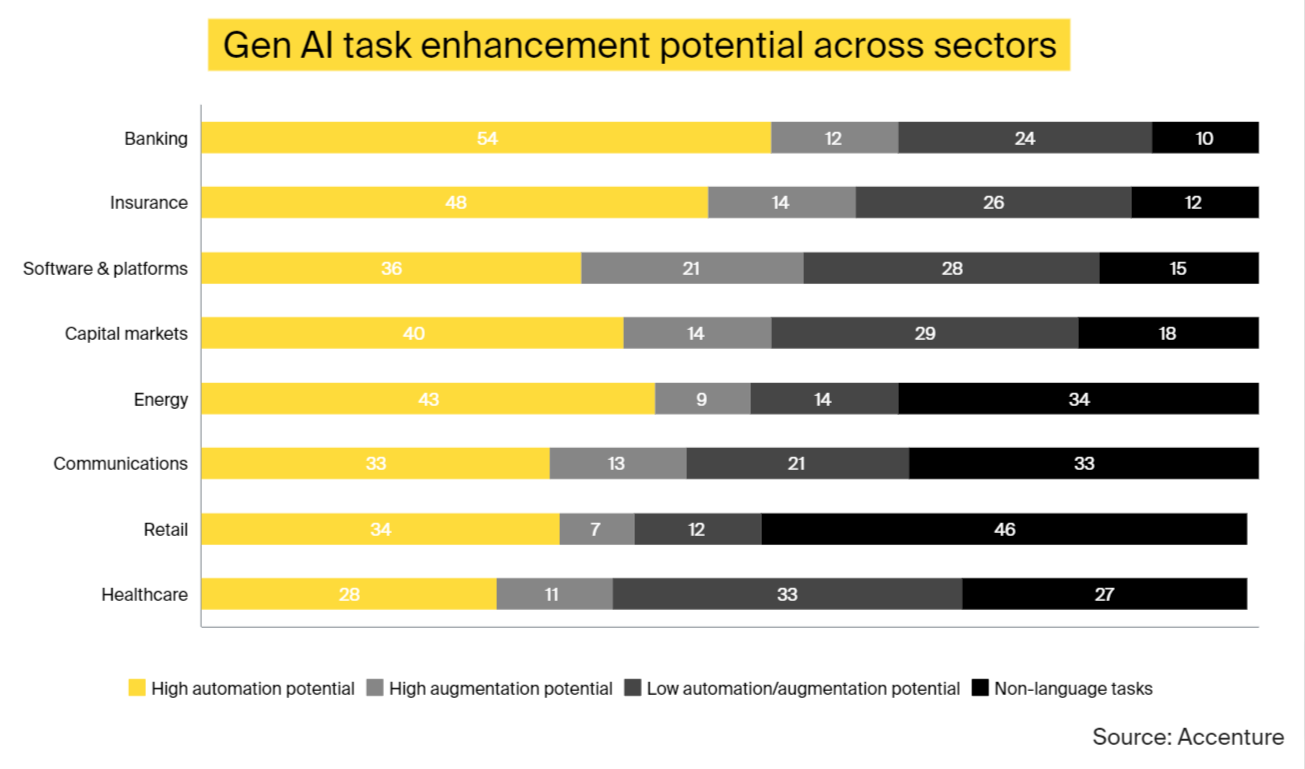

Accenture believes that banking and insurance coverage have the most important potential for automation utilizing Gen AI.

At present, generative AI is generally serving to the monetary sector automate guide duties and ship monetary providers. It nonetheless cannot deal with end-to-end automation of processes with out human intervention. For instance, the expertise cannot uncover an early pattern, devise a technique on methods to use it to an organization’s benefit, and execute the technique autonomously. Or craft a customized buyer funding portfolio and put it to motion robotically with out human verification.

Extensive-scale adoption is gradual due to the delicate nature of economic establishments’ operations, information privateness, and the organizations’ fiduciary responsibility to guard prospects from misinformation and misleading output.

However listed below are 4 stable advantages that generative AI already brings to the monetary sector:

- Decrease prices. In response to a current MIT report, the true worth of generative AI within the monetary sector lies in value discount. And the vast majority of these reductions will come from automating guide duties and releasing staff’ time to do larger worth work.

- Larger productiveness. Accenture discovered that massive language fashions can have an effect on 90% of all working hours within the banking sector. And BCG states that corporations that deploy Gen AI instruments can improve productiveness by as much as 20%.

- Higher buyer expertise. Generative AI is nice at personalization. For instance, Magnifi presents an funding platform that makes use of ChatGPT and different software program to provide customers personalised funding recommendation. And this is just one instance. Gen AI can even assist staff of their communications with shoppers, serving to them find info quicker and scale back ready time.

- Higher resilience and threat administration. FinTech generative AI can reduce dangers related to monetary services. As an example, a North American financial institution depends on Gen AI fashions to investigate mortgage candidates’ monetary information. This helps keep away from the chance of consumers defaulting on loans.

Key 7 generative AI use circumstances in monetary providers

Disclaimer: In a number of the highlighted use circumstances, companies have to strategically mix conventional and generative AI to unlock essentially the most worth. In different situations, Gen AI does the job by itself.

Use case 1: Monetary reporting, summarization, and knowledge evaluation

Monetary generative AI can study to draft monetary studies, comparable to monetary statements, price range, threat, and compliance studies. Human staff will then overview these drafts and alter them as wanted.

Gen AI fashions can undergo in depth quantities of information and current insights in concise, comprehensible summaries. These instruments can even reply to queries and extract brief solutions from massive doc heaps. As an example, a cyber insurance coverage firm, Cowbell, launched its MooGPT instrument, which might search the agency’s monetary information base and provides brief solutions to insurance coverage brokers in actual time when they’re on the telephone with a policyholder.

Use case 2: Customized monetary suggestions

One other utility of generative AI in finance is segmenting prospects primarily based on their monetary standing and demographics. Brokerage companies can use this division to provide suggestions tailor-made to buyer teams.

There may be additionally analysis into FinTech generative AI fashions that might choose funding property for a balanced portfolio. One other analysis avenue is constructing algorithms that may course of incoming information and consider its influence on asset pricing.

JPMorgan is growing its personal Gen AI bot, IndexGPT, which can give custom-made funding recommendation by analyzing monetary information and choosing securities tailor-made to particular person prospects and their threat tolerance.

Use case 3: Digital assistants

Gen AI-powered instruments can act as assistants to human staff in numerous capabilities.

One instance is an AI coding assistant that helps builders construct monetary software program and uncover bugs. Goldman Sachs is experimenting with generative AI to help programmers with code writing. The corporate witnessed a 20-40% improve in productiveness of their software program improvement division.

In one other instance, KPMG is utilizing its long-term partnership with Microsoft to entry OpenAI’s expertise to assist its tax division. Now, each tax marketing consultant has entry to a ChatGPT instrument residing inside KPMG’s firewall. The consultancy needs to include ChatGPT into different services and expects as a lot as $12 billion in income from these initiatives.

Use case 4: Protection towards monetary crime

FinTech generative AI can spot suspicious monetary actions and assist with crime investigation.

A criminal offense and threat administration software program firm, NICE Actimize, constructed a Gen AI-powered instrument to assist human employees in investigating monetary crimes. It could analyze and summarize information, difficulty alerts, generate studies, and extra. The corporate claims that its instruments can minimize the investigation time by 50% and even by 70% relating to suspicious exercise report (SAR) submitting.

Use case 5: Market intelligence

Massive language fashions can crawl the web and social media platforms to find market insights, comparable to shifts in demand, and collect intelligence on the competitors.

Morgan Stanley’s Wealth Administration division deploys OpenAI expertise to mine the financial institution’s proprietary information. And Bloomberg just lately launched its BloombergGPT – a big language mannequin that was educated on an unlimited monetary dataset containing 700 billion tokens. Folks can use this Gen AI mannequin to go looking Bloomberg’s monetary information and acquire summaries and monetary insights.

One other utility of finance generative AI on this context is to simulate numerous market situations, consider potential outcomes, forecast market developments, and present how these will have an effect on funding portfolios.

Use case 6: Contract era and administration

By analyzing monumental units of specialised paperwork, Gen AI can study the nuances of authorized language and produce drafts of various contract varieties. It could assist articulate non-standard phrases, examine contract situations, produce summaries, and generate arguments for negotiating favorable phrases.

An American monetary company, BNY Mellon, historically spent numerous time dealing with custodial agreements. For every settlement, there was a workforce of attorneys who composed a draft and navigated a fancy approval system. The corporate employed an AI vendor to customise a generative AI mannequin to streamline custodial agreements. Not solely did this instrument produce stable custom-made drafts, but it surely additionally despatched these drafts to the corresponding stakeholders, alerting them to any non-standard clauses and lacking particulars.

Use case 7: Anomaly and fraud detection

In response to a 2023 KPMG survey, fraud detection got here on high of the listing of generative AI purposes in finance, with 76% of the respondents saying the expertise advantages this trigger.

Gen AI can monitor monetary transactions in massive organizations in actual time and spot any anomalies, comparable to sudden modifications in spending conduct. These fashions can even flag suspicious collaborations involving complicated fraud schemes.

FinTech companies can even depend on Gen AI to identify suspicious actors on their platforms. Stripe, an Irish-American monetary providers firm, makes use of GPT-4 to determine malicious actors on its group discussion board. The instrument can flag questionable accounts and notify Stripe’s fraud workforce members to analyze.

Try our current article on generative AI in banking if you’re wanting to discover extra specialised banking purposes. We even have a common information on Gen AI use circumstances in enterprise if you’re searching for industry-independent concepts.

Challenges of implementing generative AI for monetary providers

- Legacy expertise. Monetary establishments have been among the many first to undertake expertise again in its early days. Sadly, many organizations nonetheless follow the legacy software program programs that gave them a aggressive edge up to now. Analysis reveals that the previous programming language COBOL nonetheless helps 80% of bank card actions and 85% of ATM transactions. This and different previous applied sciences, programs, and remoted information silos that match the aim again within the day are sarcastically hindering progress now.

- Lack of expertise. Generative AI is a comparatively new expertise, and there’s not sufficient experience within the expertise market. However historical past reveals that this isn’t a long-term drawback, as individuals will acquire expertise and {qualifications} over time.

- Bias and lack of explainability. Gen AI fashions are as truthful as their coaching datasets. They will prepare on any information accessible on the web, take up, and replicate its toxicity. One traditional instance in finance is discrimination in credit score allocation. Gen AI algorithms can exhibit bias towards sure inhabitants cohorts. And the truth that superior Gen AI fashions are black-box by design and cannot clarify their end result solely exacerbates the state of affairs.

- Mannequin hallucination. Gen AI can confidently supply believable however incorrect info. If you’re a monetary advisor, a hallucinating mannequin will strongly undermine your competence in entrance of shoppers.

- Mental property rights. These massive fashions can prepare on information from public sources whereas additionally utilizing IP-guarded info with out permission. For instance, if you wish to ask Gen AI to write down a monetary app and it trains on licensed monetary software program and produces one thing comparable, this may violate IP rights. And one other query right here is whether or not you’ll be able to license software program written with Gen AI.

- Regulatory uncertainties. There are various unanswered regulatory questions surrounding Gen AI in finance. What ought to we do if an algorithm learns to control costs? If you’re a buyer who obtained horrible monetary recommendation out of your financial institution’s Gen AI, who are you able to sue? What if malicious actors use this mannequin to control the market? Within the worst-case state of affairs, this could threaten the nation’s monetary stability.

Implementing generative AI in finance: a step-by-step information for CFOs

These steps will make it easier to put together for Gen AI deployment and keep away from issues whereas utilizing the expertise sooner or later.

Choose the correct Gen AI use circumstances in finance

Begin experimenting with just a few enterprise circumstances which have a tangible impact on the monetary perform, will not be overly complicated, and are backed by key stakeholders.

Do not rush into Gen AI initiatives simply due to the expertise. Do not gallop wildly to show all of your operations into one massive chatbot. There is no such thing as a have to spend money on Gen AI for circumstances the place different much less superior and cheaper expertise can do the job simply as effectively.

Resolve on constructing vs. shopping for a finance generative AI mannequin

Constructing a basis mannequin from scratch is not possible for many corporations as a result of Gen AI improvement prices are excessively excessive. So, you’ll be able to select from the next, extra reasonably priced choices:

Possibility 1: Use an open-source Gen AI mannequin

You possibly can combine an open-source mannequin, like GPT-2, with out paying a subscription price. However you may be chargeable for all of the infrastructure prices that may be wherever between $37,000 and $100,000 for the preliminary setup, to not point out recurring bills on electrical energy, upkeep, and many others.

Possibility 2: Retrain an open-source resolution in your information

This opens the likelihood for personalization and very good efficiency, however you’ll want to mixture and clear the coaching dataset and provide a server that may deal with the load. Put together to spend $80,000-$190,000 on retraining a reasonably massive mannequin.

Possibility 3: Deploy a commercially accessible mannequin as is

You possibly can pay license charges to connect with a close-source mannequin, comparable to ChatGPT, together with your present software program. Some Gen AI distributors cost primarily based on the variety of characters within the output textual content, whereas others cost per token (a gaggle of characters). The seller updates and maintains these instruments and presents detailed documentation. On the draw back, the customization choices are restricted, and your crucial duties are on the vendor’s mercy.

Possibility 4: Retrain a business mannequin in your information

You possibly can tailor a ready-made mannequin to your online business wants by retraining it in your information. Right here, you’ll pay the retraining prices along with the seller’s charges.

Safeguard towards bias and malicious efficiency

After retraining a Gen AI mannequin or deploying a ready-made resolution as is, assess the instrument for equity and conduct common audits to make sure the mannequin’s end result stays bias-free because it good points entry to new datasets. Additionally, validate if the mannequin can infer protected attributes or commit another privateness violations.

Take a look at if the mannequin has any dangerous capabilities that may be exploited to make it act in adversarial methods.

Encourage collaboration between AI engineers and finish customers

Encourage AI builders to contain finish customers in mannequin coaching and customization. They may give suggestions that engineers can use to refine the instrument in additional iterations. Along with bettering the mannequin, this collaboration will improve AI acceptance in your organization.

Put together the workforce

You have to a workforce that may make it easier to prepare and deploy monetary generative AI options. You possibly can depend on your in-house staff or rent a devoted workforce of execs to assist you on this endeavor with out having to maintain them on the payroll afterwards.

Additionally, you will want to coach your inside employees, who will work with generative AI-infused processes.

Set up accountable AI framework

You possibly can reduce Gen AI dangers by providing detailed tips on methods to use these instruments. For instance, PayPal has an AI middle of excellence to assist staff. The corporate drafted a accountable AI framework explaining methods to use Gen AI instruments. As an example, it prohibits staff from importing delicate company info to open-source generative AI instruments.

You can begin with the next:

- Arrange accountability mechanisms, insurance policies, and ethics, particularly relating to high-profile purposes, comparable to giving funding recommendation

- Specify tips for workers to observe when utilizing the fashions in numerous settings

- Embrace management mechanisms, comparable to kill switches, to terminate mannequin involvement within the case of disruptions

- Use a human-in-the-loop strategy to make sure the mannequin provides affordable solutions in high-stake conditions

- Doc the information that was launched to the mannequin and resolve the way you handle consent, the correct to be forgotten, and different compliance components

To sum it up

From the real-life examples introduced on this article, you’ll be able to see that generative AI is a helpful instrument for the monetary sector. And there’s extra to return.

Mike Mayo, financial institution analyst at Wells Fargo, stated,

The dream state is that each worker can have an AI copilot or AI coworker and that every buyer can have the equal of an AI agent.

Is it price implementing generative AI in monetary providers proper now? In response to the KPMG survey of US executives, round 60% of the respondents talked about they would wish no less than a 12 months to implement their first Gen AI resolution. This was again in March 2023. However even if you’re not ready to provoke a large-scale undertaking but, it is time to experiment with smaller tasks to know what suits your organization greatest. So, get in contact, and we will likely be completely satisfied to supply our providers.

Are you trying to minimize prices whereas bettering worker productiveness and buyer expertise? Drop us a line! We will likely be completely satisfied to help you to find the correct mannequin, retraining it, and integrating Gen AI into your day by day operations.

The publish How Generative AI in Finance Cuts Prices and Improves Buyer Expertise appeared first on Datafloq.