Whereas last-minute tax filers stare down the clock, scammers search for simple pickings. Tax scams are in full swing as April 15th approaches, and we’ve a rundown of the highest ones making the rounds this 12 months.

For starters, the stakes this 12 months stay the identical as ever. Scammers are benefiting from the stress and uncertainty that comes with tax season as they aim folks’s private information, cash, or each. Their avenues of assault stay the identical as properly, by way of electronic mail, texts, direct messages, and the telephone.

But there’s a brand new wrinkle this 12 months. Scammers have tapped into AI instruments that make their scams feel and appear way more subtle than ever.

We noticed the primary stirrings of AI-driven scams final 12 months as AI instruments first entered {the marketplace}. This 12 months, AI-driven scams characteristic increasingly more within the panorama of threats. Scammers use them to generate pictures, write copy, and construct web sites in a fraction of the time that it as soon as took. Whereas they nonetheless make a number of the design and writing errors they’ve made prior to now, they make far fewer of them.

Examples of tax scams we’ve noticed this 12 months.

We’ve got a few tax scams to share from the numerous we’ve uncovered. The primary one includes a preferred model of tax software program right here within the U.S.

Instance of a scammer electronic mail

At first blush, this bogus electronic mail seems to be fairly legit. At first. The format, {photograph}, and hyperlink all appear to be commonplace fare for an electronic mail. Although wanting extra intently, you may spot a number of AI fingerprints throughout it.

For one, massive manufacturers like TurboTax have writers, editors, and reviewers who comb over copy earlier than it will get accepted for launch. Right here, the headline breaks a reasonably commonplace formatting rule. In “headline case” writing, the “with” needs to be lowercase. Certain, errors get made, and this may be one instance. But the issues go deeper than that.

Learn the advantageous print. You’ll see that the grammar is off. The paragraph total has a damaged really feel to it. You’ll additionally see that the copy mentions “market chief” twice — and awkwardly so. And what firm mentions its opponents in an electronic mail like this? They’re not out to spice up opponents.

Lastly, the e-mail spells out the corporate’s title mistaken within the advantageous print. It’s “TurboTax,” not “Turbo Tax with License Code.” All of this factors to an apparent faux. However solely by wanting intently at it. It’s as if the scammers prompted an AI chatbot with “Describe what TurboTax is” and acquired this as a response.

Granted, that represents an instance of quite sloppy work. The following instance seems to be extra convincing. This time, the scammers impersonate the IRS:

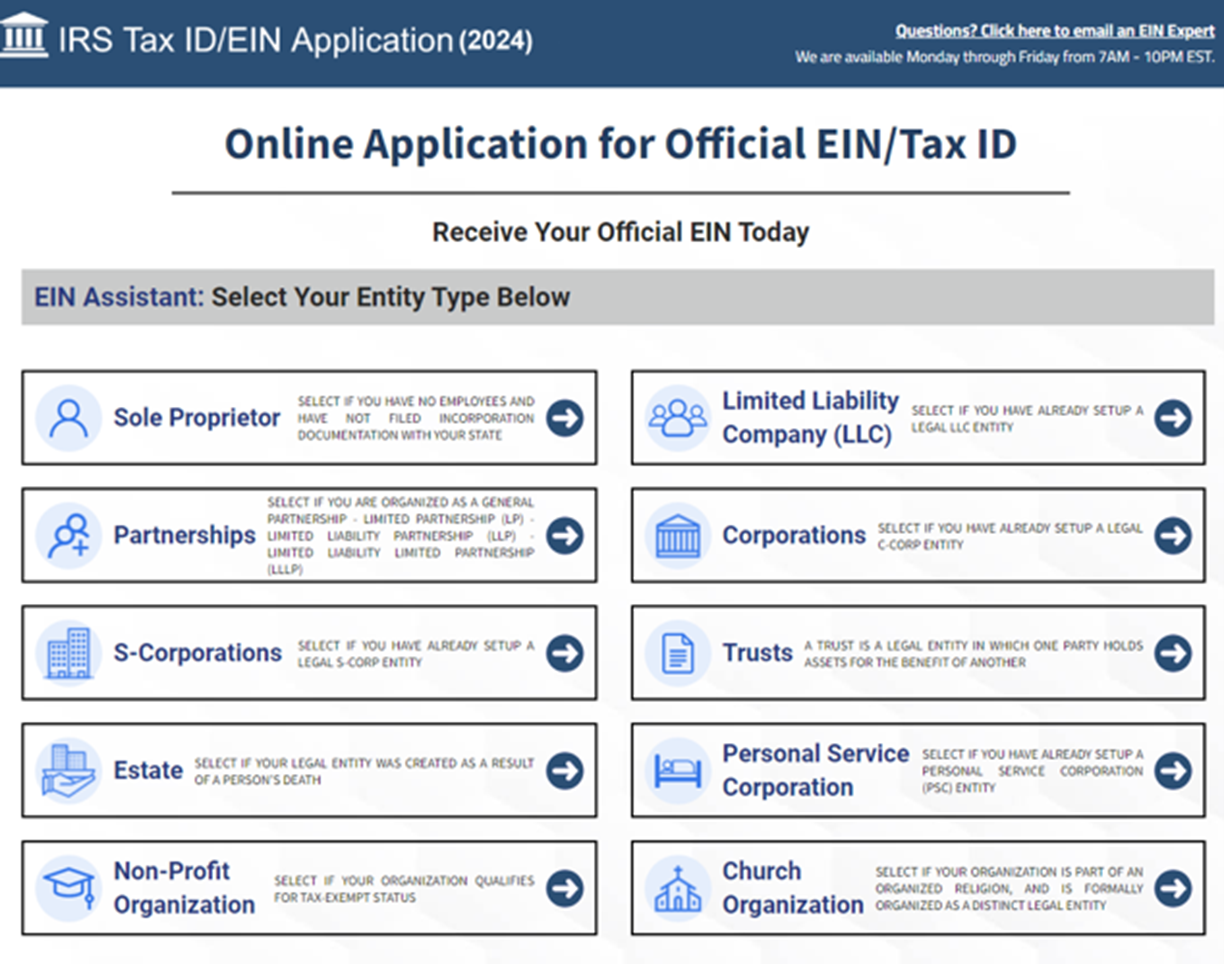

Instance of a scammer web site

We found this faux IRS website when our McAfee Labs group investigated a hyperlink despatched in an electronic mail. The bait is the promise of getting a tax ID quantity for a enterprise or group. The hook is that this bogus website designed to reap private and enterprise information.

For those who’ve visited the IRS website not too long ago, you’ll acknowledge the feel and appear of an IRS webpage rapidly. It appears acquainted sufficient, but as soon as once more a more in-depth look reveals a couple of issues.

First, a small grammatical error rears its head within the copy. The time period “setup” is a noun, but the copy makes use of it as a verb. It ought to learn “arrange” as an alternative. Granted, it is a widespread error. Many websites make it, but it’s a purple flag nonetheless. Subsequent, the contact methodology within the high proper raises one more. Contact “an EIN knowledgeable” by way of electronic mail throughout set hours? Set hours are for telephone calls, not electronic mail.

We omitted the ultimate telltale signal — the URL. It was clearly a faux and never the official irs.gov handle.

In all, it exhibits simply how cagey tax scammers could be as we speak. Significantly with AI. It places a contemporary look on some outdated ways, making scams more durable to identify.

Now, onto our high tax scams for 2024.

Sketchy electronic mail attachments — the 5 hottest varieties.

This basic is again. Scammers unfold all method of malware with electronic mail attachments. One instance: spyware and adware that steals information as you kind usernames and passwords as you log into your accounts. One other: ransomware that holds the info in your system hostage till you pay. Perhaps. The listing goes on, but scammers all the time attempt to bundle it up in a manner that appears legit.

A method they pull that off is with a phony tax doc bundled up in a .pdf doc. In truth, the .pdf format marks the primary file kind that hackers and scammers use of their assaults. By our rely, it tops the quantity two file kind by a ratio of roughly 6 to 1.

Listed here are the highest 5 file varieties utilized by scammers and hackers:

- .exe

- .zip

- .html

- .textual content

What makes the .pdf format so standard? Folks belief it. It will get generally utilized in enterprise, and plenty of official tax varieties are available in that format. Nevertheless, it additionally affords a flexible platform for exploits. Hackers and scammers can embed malicious hyperlinks and content material inside them. So clicking what’s inside that .pdf doc can result in bother, say within the type of a malicious web site designed to steal private information.

Beginning within the second half of final 12 months, we famous a spike in malicious attachments that used the .pdf format. One more reason that makes .pdf recordsdata so standard, electronic mail filters are inclined to give attention to different file varieties just like the executable .exe format. So, a .pdf has a greater shot at slipping by means of.

Our recommendation:

As all the time, robust antivirus software program can detect and shield you from malicious electronic mail attachments. Our Subsequent-gen Menace Safety present in all our McAfee+ plans as soon as once more proves itself as a high choice for antivirus. Outcomes from the impartial lab AV-TEST in December 2023 noticed it block 100% of completely new malware assaults in real-world testing. It likewise scored 100% in opposition to malware found within the earlier 4 weeks. In all, it obtained the best marks for cover, efficiency, and value — incomes it the AV-TEST Prime Product certification.

Tax time phishing scams.

Phishing scams crop up in loads of locations and take loads of varieties. As in years previous, we see scammers cranking up their bogus texts, direct messages, and emails. All of them observe the tax season theme, but they take totally different approaches to roping in victims. Some embody:

- Attachments with phony tax paperwork, like W2 and 1099 varieties.

- Rip-off texts that alert the taxpayer of an unclaimed refund.

- Imposter schemes, like social media messages from individuals who pose as official IRS brokers.

- Faux affords for tax prep software program (just like the TurboTax instance above).

Moreover, many phishing assaults level folks to malicious web sites — as soon as once more that steal private information. We’ve seen a spike in malicious tax-related URLs beginning within the second half of final 12 months as properly.

Our recommendation:

You possibly can completely shield your self from phishing scams. Now with the assistance of AI. McAfee Rip-off Safety detects suspicious URLs with AI earlier than they’re opened or clicked on. This takes the guesswork out of these typically convincing-looking messages by letting you realize in the event that they’re fakes. For those who by accident click on or faucet on a suspicious hyperlink in a textual content, electronic mail, social media, or browser search, it blocks the rip-off website from loading. You’ll discover McAfee Rip-off Safety throughout our McAfee+ plans.

Faux charity scams additionally crop up this time of 12 months.

Whether or not it’s for pure catastrophe support, aiding refugees in war-torn areas, and even defending animals and pets, scammers arrange phony charities with the goal of pulling heartstrings. After which stealing cash consequently.

Scammers attain out with the same old strategies, by electronic mail, textual content, direct message, and typically telephone calls as properly. All of them share one factor in widespread. All of them give potential victims an opportunity to assist a trigger that they take care of and get a tax credit score in return. But with these scams, the charity doesn’t exist. As an alternative, cash and private information find yourself within the arms of scammers.

Our recommendation:

But you’ve gotten a number of methods you may spot a faux charity. For one, the message typically has a urgent, nearly alarming, tone. One which urges you to “act now.” Earlier than appearing, take a second. Analysis the charity. See how lengthy they’ve been in operation, how they put their funds to work, and who actually advantages from them.

Likewise, notice that some charities go alongside more cash to their beneficiaries than others. Typically, most respected organizations solely maintain 25% or much less of their funds for operations, whereas some less-than-reputable organizations maintain as much as 95% of funds, leaving solely 5% for advancing the trigger they advocate. Within the U.S., the Federal Commerce Fee (FTC) has a website stuffed with assets so as to make your donation actually rely. Assets like Charity Watch and Charity Navigator, together with the BBB’s Clever Giving Alliance can even assist you to establish one of the best charities.

Maintain an ear out for rip-off calls.

Scammers like to select up the telephone too. A well-liked type of assault includes “the decision from the IRS.” Sometimes, a recorded message notifies the recipient that they owe cash. And since scammers know simply how jarring a name from the IRS could be, they apply heavy strain within the message.

Up to now, we’ve heard messages that threatened fines, jail time, and revoking driver’s licenses. They’ve talked about the police and different legislation enforcement brokers in them as properly, simply to show up the warmth.

Now with AI, scammers can create robocalls that sound extremely reasonable in solely moments of time. It’s so simple as writing a couple of strains of a script, feeding it into an AI software, after which producing an audio file. No want for an additional individual to report the message. AI takes care of all of it.

Our recommendation:

One of the simplest ways you may keep away from falling for this rip-off is by realizing what the IRS will and won’t do after they contact you. From the irs.gov web site, the IRS is not going to:

- Provoke contact with taxpayers by electronic mail, textual content messages, or social media channels to request private or monetary information.

- Name to demand instant cost utilizing a particular cost methodology equivalent to a pay as you go debit card, present card, or wire switch. Typically, the IRS will first mail a invoice to any taxpayer who owes taxes.

- Demand that you just pay taxes with out the chance to query or enchantment the quantity they are saying you owe. You also needs to be suggested of your rights as a taxpayer.

- Threaten to herald native police, immigration officers, or different legislation enforcement officers to have you ever arrested for not paying. The IRS can also’t revoke your driver’s license, enterprise license, or immigration standing. Threats like these are widespread ways rip-off artists use to trick victims into shopping for into their schemes.

Lastly, additionally know that the IRS is right here to assist. The company affords a full assist web page with on-line assets, together with a number of methods you may contact the IRS for assist. You probably have any questions on a notification that you just obtained, contact them.

Much more safety from tax-time scams…

Whereas scammers have a wealth of instruments obtainable to them, you’ve gotten one software that protects you from all types of threats. Complete on-line safety software program like McAfee+ affords but extra methods to avoid tax scams.

Along with the antivirus and rip-off safety options we talked about, it will possibly make you extra personal on social media, which might stop scammers from profiling you. It could additionally take away your private information from the info dealer websites scammers use to contact their victims. (Granted, scammers must get your contact information from someplace, and these websites provide that information, plus rather more.) Additionally, a VPN might help you join and file your taxes much more securely, so what you do stays personal.

And if the unlucky occurs, our identification theft protection might help you recuperate. It supplies $2 million in identification theft protection and a licensed restoration knowledgeable who might help restore your identification.

Sure, we’re seeing loads of outdated scams with new twists this 12 months. But the identical methods you may shield your self from them solely get higher and higher.