Google search promoting spend within the U.S. rose by 17% year-on-year within the first quarter of 2024. Click on development continued to sluggish, hitting 4% YoY (in comparison with 8% in This autumn 2023).

Price-per-click continues to extend – up 13% YoY (in comparison with a 9% year-on-year enhance in This autumn 2023).

CPC enhance. This was most affected general by a rise in Buying adverts CPC (each commonplace and PMax).

- CPC elevated by 13%, an enormous bounce from the 6% year-on-year enhance in CPC of This autumn 2023.

- That led to a 21% enhance in advert spend year-on-year in Q1 2024, in comparison with the 13% enhance year-on-year in Q1 2024.

Google Search. CPCs are up 40-50% for retailers prior to now 5 years.

- The everyday retail model operating Google search adverts has seen its common CPC rise by 40-50% in comparison with 5 years in the past.

- From Q1 2023 to Q1 2024, Google retail search advert CPCs rose about 20% for the median advertiser.

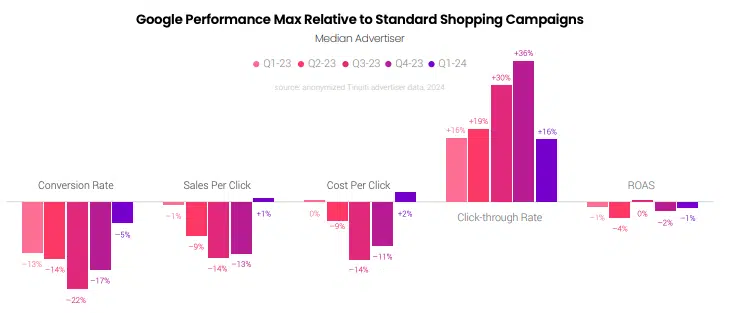

PMax. Efficiency Max campaigns enhance from quarter to quarter.

- The relative efficiency of PMax campaigns in comparison with commonplace Buying campaigns (SSCs) improved throughout most key metrics from quarter to quarter.

- Conversion charge was solely 5% lower than that of SSCs, in comparison with it being 13% worse final 12 months, and 17% worse in This autumn 2023.

- PMax price per click on is 2% higher than SSCs CPC, in comparison with it being 11% worse in This autumn 2023.

PMax continues to play a outstanding function in promoting on Google:

- In the course of the peak of the This autumn 2023 vacation procuring season, 91% of shops putting procuring adverts with Google had been operating PMax campaigns, which remained secure over Q1 2024

- On common, 89% of Google procuring advertisers had been operating PMax campaigns throughout Q1 2024, up from the 82% common in Q1 2023.

Why we care: CPCs are rising whereas clicks are reducing. That is dangerous information throughout for advertisers. Particularly since Google reportedly had been rising advert costs to fulfill targets.

Report methodology. The Tinuiti Digital Adverts Benchmark Report makes use of anonymized efficiency knowledge from promoting packages managed by Tinuiti. The info relies on lively packages with constant methods. All figures signify same-client development and should not meant to formally mirror any particular promoting platform’s efficiency or the experiences of each advertiser.

About Tinuiti. Tinuiti is a big impartial efficiency advertising agency with over 1,000 workers that manages $4 billion in digital media.

New on Search Engine Land