Myrealtrip is the newest journey tech firm to journey a rising post-pandemic tourism trade. The Seoul-based startup mentioned at present it has raised $56.7 million (75.6 billion KRW) in a Sequence F fairness spherical of funding to speed up its enterprise and product innovation and ramp up its hiring.

International tourism has rebounded to pre-pandemic ranges within the third quarter of 2023, in response to a current UN World Tourism Group report. Journey tech corporations once more put together to hurry up their enterprise growth.

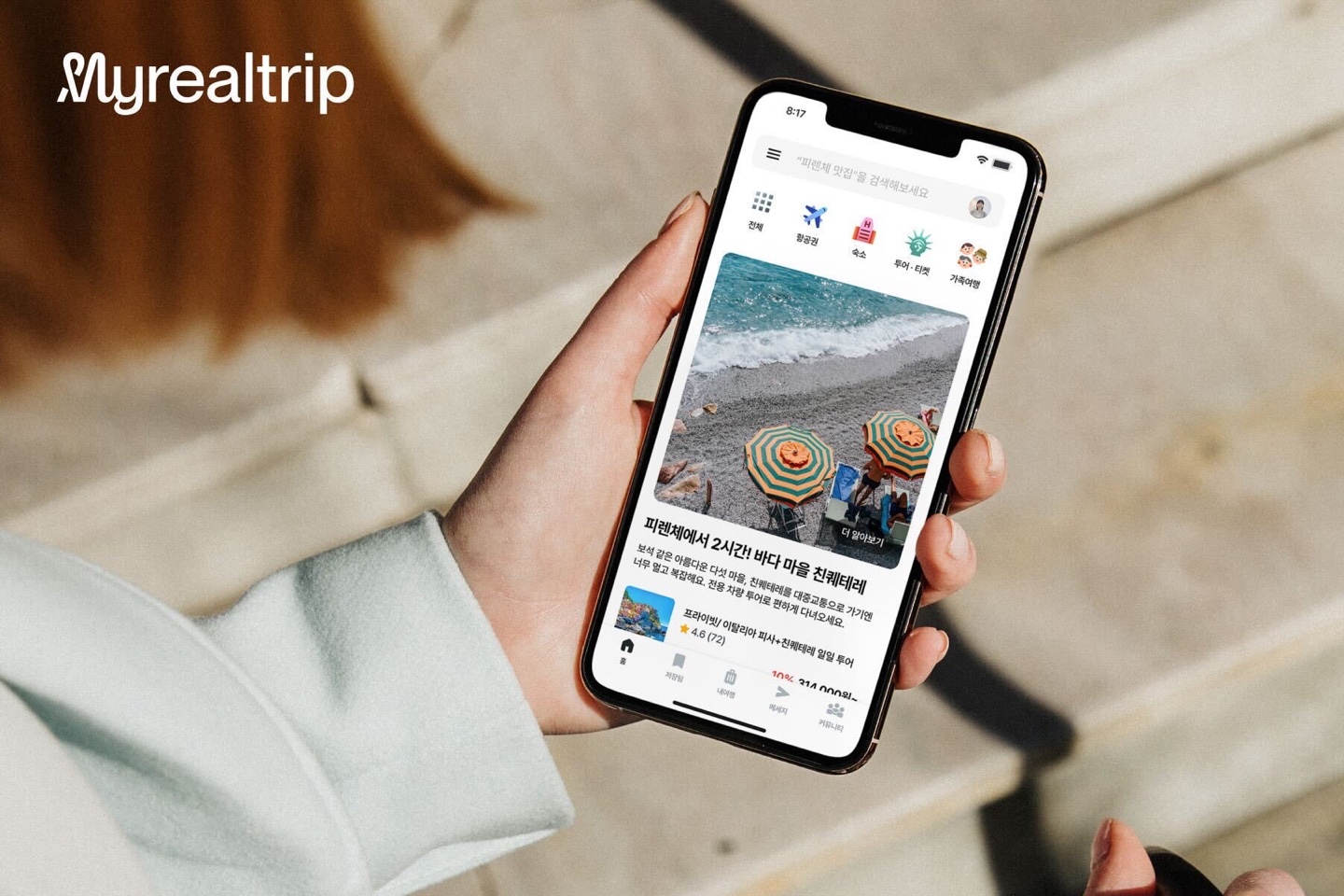

“The journey trade was fragmented 12 years in the past in South Korea, and there was no platform that supplied journey info,” CEO of Myrealtrip Donggun Lee mentioned in an unique interview with TechCrunch. Now the 12-year-old firm, which has 7.9 million customers in South Korea, goals to be an excellent app within the journey trade, providing journey reserving companies, from flights, lodging, actions, to native transportation.

The corporate partnered with round 2,000 journey businesses, lodge platforms, and airfare comparability service suppliers like Expedia, Agoda, and Viator to allow vacationers to e book companies excursions, actions, eating places, native transportation, lodges and Airbnb-like lodging globally.

Its valuation elevated by 3x since its final fairness funding, Sequence D, in 2020, Lee advised TechCrunch, with out offering an actual determine. The corporate valuation was estimated at greater than 200 billion KRW in 2020, per earlier media shops.

Lee additionally mentioned that Myrealtrip had seen its income surge by thrice since 2022. The outfit posted a gross merchandise quantity (GMV) of $746 million (1 trillion KRW) in 2023. It goals to double its GMV and generate an EBITDA of $12 million this 12 months, Lee famous.

Picture Credit: Myrealtrip

Like most journey corporations, the Korean startup confronted challenges through the pandemic lockdown. The corporate says it might survive with the capital it had secured in 2020 and debt financing in 2022 in preparation for post-pandemic.

“Myrealtrip prioritized home tourism and launched new options like a bunch journey or enterprise journey to outlive for the final two difficult years,” Lee mentioned.

The corporate didn’t simply develop its home tourism but additionally made a number of acquisitions and strategic investments. Myrealtrip acquired Startrip in 2022 to seize the variety of overseas vacationers visiting South Korea post-pandemic. This journey platform lets customers uncover and e book Korean-pop (Okay-pop) themed spots, together with common boy band BTS music video filming places. Lee mentioned it plans to function Startrip as a separate entity to enhance its service with superior know-how.

Myrealtrip additionally invested in IwaTrip, a Korean journey platform that helps customers discover accessible spots to journey with children, and O-Peace, a co-working and co-living area platform designed for digital nomads staff.

Know-how will probably be key to the long-term success of drawing its inbound and outbound journey customers in addition to overseas vacationers to tackle its opponents like SoftBank-backed Klook, which raised $210 million final month; Yanolja; Agoda; and Airbnb.

Lee mentioned the corporate, which makes use of AI chatbots for buyer companies, will make investments extra in know-how, together with AI capabilities, earlier than its deliberate preliminary public providing in 2026.

Returning buyers BlueRun Ventures Korea and IMM Funding co-led the spherical, which brings its whole raised to roughly $113 million (150 billion KRW) in fairness and $39 million in debt since its inception in 2012. New buyers Korelya Capital, marking its first funding in South Korea, and Vanderbilt College’s endowment fund and former backers, together with Altos Ventures, Partech Companions, Smilegate and SV Funding, additionally joined the Sequence F.

The corporate has 300 staff as of at present.