(Summit Artwork Creations/Shutterstock)

Don’t look now, however various information is shortly changing into a requirement for achievement, at the least within the monetary providers trade. That’s the conclusion of current research that discover curiosity in various information within the monetary providers trade is skyrocketing, and that spending on various information might quickly outpace conventional information.

The definition for various information will not be utterly nailed down, however primarily it’s any sort of information that doesn’t match neatly into the containers historically used for analytics. Within the monetary providers trade, which means all the information that’s not contained in issues like quarterly and annual experiences, press releases, and analyst experiences. That places information from bank card transactions, cell gadgets, social media posts, satellite tv for pc imagery, Internet-scraped information, and geolocation information squarely within the purview of different information.

Use of different information began with hedge funds a few decade in the past, however as we speak all varieties of traders are utilizing it as we speak. Most traders need to various information to achieve a aggressive edge over different traders, or to achieve “alpha,” as they are saying. The massive demand led Bloomberg so as to add a feed for various information in its iconic terminal final fall.

In a 2023 report, Deloitte discovered that variety of various information units relevant to monetary providers elevated by about 36% over the previous two years, whereas the variety of various information suppliers elevated by about 30% over the identical interval.

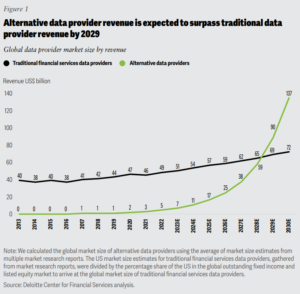

Different information income is projected to exceed conventional information by 2029 (Supply: Deloitte)

At present, almost all the traders surveyed by Deloitte (98%) say various information is more and more essential for figuring out alpha. That implies that traders that don’t partake of different information more and more discover themselves at a drawback, Deloitte says.

“Because the utilization of different information turns into mainstream, organizations that rely totally on their conventional monetary information for making funding choices could also be unable to make totally knowledgeable funding choices,” the corporate says.

The curiosity in various information is driving a surge in gross sales by various information brokers. In keeping with Deloitte, the nascent international marketplace for various information was price lower than $1 billion as just lately as 2016, however shortly sprouted right into a $5 billion market by 2022. Deloitte initiatives the overall worth to skyrocket to $59 billion inside 5 years, placing it at roughly the identical worth as the normal information market. Nevertheless, the expansion trajectory for various information will take it properly past $100 billion by 2030, Deloitte forecasts, using a 29X progress price and a CAGR (compound annual progress price) approaching 60%

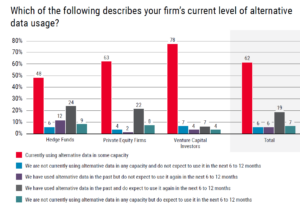

Extra information on the speedy uptake of different information involves us from Lowenstein Sandler, a legislation agency that’s been surveying the usage of various information amongst non-public fairness funds, and enterprise capital funds for the previous 4 years. The corporate final week launched its newest report on various information, which concluded that use of different information has doubled from final yr.

“The proportion of respondents at present utilizing various information doubled from 31% final yr to 62% this yr,” the report’s authors wrote. “The best improve got here from these in enterprise capital, with 78% reporting utilizing it in comparison with 11% final yr.”

Three out of 4 corporations say they they’ll improve their spending on various information in 2024, with most will increase within the 11% to 25% vary. Nevertheless, solely about 28% of survey respondents say their budgets would improve by greater than 25% this yr, which was down from 65% final yr. That led the agency to conclude that help for spending will increase for various information seem like waning.

A lot of the corporations surveyed by

–about 80%–need to spend from $100,000 to $2 million on buying various information this yr, the survey discovered. About 10% of corporations throughout hedge funds, non-public fairness corporations, and enterprise capital corporations need to spend greater than $3 million.

Most surveyed corporations need to pair various information with AI, resembling for streaming information analytics, predicting buyer outcomes, discovering insights, or automating routine duties. About half of the corporations surveyed say they’re at present evaluating AI and one other quarter planning to implement it. General, about 16% of the corporations surveyed by Lowenstein Sandler say they’re at present operating AI atop various information, whereas solely about 8% say they don’t have any plans to make use of AI with it.

“Different information–with the assistance of AI–seems like it’s right here to remain, as evidenced by its more and more accepted use by hedge, non-public fairness, and enterprise capital fund managers trying to find a aggressive benefit,” mentioned Scott Moss, a co-chair of the funding administration and fund regulatory and compliance teams at Lowenstein Sandler. “Then again, budgets for various information could maintain tempo with its elevated use because the market evolves.”

Different information may give firms an edge, but it surely’s not with out its dangers. Probably the most cited threat of utilizing various information had been considerations about safety breach points, which was shared by about 38% of Lowenstein Sandler survey respondents. A insecurity of their potential to derive worth from various information was subsequent on the record at 34%. That very same share feared their potential to extract related information from a big quantity of different information, whereas 24% say they had been involved about regulatory scrutiny (24%).

Associated Gadgets:

Bloomberg Makes Different Knowledge Accessible Alongside Conventional Monetary Knowledge

Different Knowledge Goes Mainstream in Monetary Companies

From First to Third, and Different Too: A Information to Knowledge Sorts