CommandBar, a B2B instrument designed to make software program simpler to make use of, closed a $4.8 million increase in 2021 with one of the crucial starkly minimalist decks I’ve ever seen. The deck solely has seven slides and is lacking a ton of actually vital info, however that didn’t cease Thrive Capital and Y Combinator from opening their checkbooks.

We’re in search of extra distinctive pitch decks to tear down, so if you wish to submit your personal, right here’s how you are able to do that.

Slides on this deck

- Cowl slide

- Product slide

- Demo slide (with a hyperlink to a Loom demo)

- Thesis slide

- Downside/aggressive panorama slide

- Worth proposition slide

- Crew slide

Three issues to like

Within the midst of a reasonably slim pitch deck, there are some improvements which can be value shining a light-weight on.

Information design, not graphic design

I’ve lengthy held that design is way much less vital than folks appear to suppose with regards to early-stage pitch decks. This is sensible: The first objective of a pitch is to speak the startup’s potential to would-be buyers. These components are basically rooted within the content material and readability of the message fairly than the aesthetics of the presentation.

That doesn’t imply that design isn’t vital, however startups would do effectively to concentrate to info design (i.e., whether or not the content material is simple to ingest and skim), fairly than graphic design; early-stage buyers are predominantly targeted on substance over fashion. They’re in search of compelling enterprise concepts with robust market potential and groups able to executing these concepts.

Focusing an excessive amount of on design can typically misallocate valuable early-stage sources. Startups usually function beneath tight price range constraints, and spending important money and time on pitch deck design is probably not the very best use of restricted sources. The effort and time might be higher spent on validating the enterprise concept, conducting market analysis and refining the services or products. In case you have a gifted designer on employees, by all means, allow them to free on the deck, however remember that nice pitch deck design is a extremely specialised area of interest in its personal proper, and different design disciplines is probably not as transferable as you suppose.

CommandBar sidesteps this by primarily not designing the deck in any respect. In doing so, the corporate created a stark, easy-to-ingest stack of slides.

[Slide 1] How’s that for minimalism. Picture Credit: CommandBar

For those who’re on revision 900 of your pitch deck, and you may’t get the design fairly proper, maybe much less is extra.

Elegant combo of downside and aggressive panorama

In my a few years of poring over pitch decks, I can’t say I’ve seen the issue slide mixed with the competitors slide earlier than, however on this case, it simply works:

[Slide 5] These go effectively collectively. Picture Credit: CommandBar

Startup founders are at all times in search of methods to make their pitch deck stand out to potential buyers. On this case, CommandBar created a contemporary take by merging its aggressive panorama and downside slides.

Sure, the design is utilitarian, however the mixture of the 2 slides sharpens the presentation and helps do one thing uncommon: It cohesively reveals the corporate’s deep market understanding and the answer’s distinctive worth.

The best a part of this slide is that it reveals that CommandBar can tackle some actually monumental markets. The corporate doesn’t have a market measurement slide (boo!), however the examples on this slide give us an concept: WalkMe has an $830 million market cap. In response to PitchBook knowledge, Zendesk final raised at a $10 billion valuation. As of its final funding spherical, Intercom and FullStory have been valued by buyers at $900 million and $1.8 billion, respectively. Again-of-a-napkin math says CommandBar goes after a market of at the very least $13 billion. Not too shabby.

I do wish to underscore that whereas integrating these slides gives some advantages, readability is essential. Make sure the slide isn’t overcrowded with info. The intention is to boost understanding and engagement, to not confuse. Cautious design and content material choice are essential to creating this technique work — and do not forget that increasingly VCs are utilizing AI to learn pitch decks to do first-sifts. My very own AI-based pitch deck instrument was confused by this slide, incorrectly figuring out it as a buyer slide. Your mileage might fluctuate, however your pitch deck does have to be machine-readable.

Simplicity

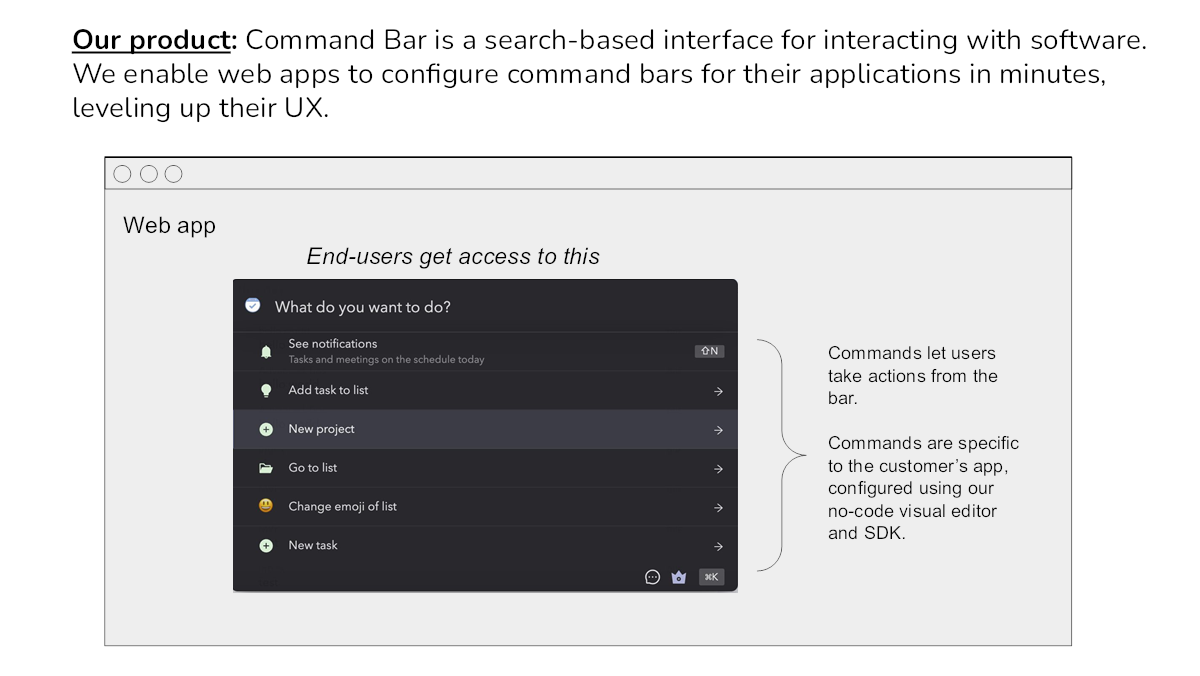

Quite a lot of founders get stumped making an attempt to specific what the corporate is doing and who it’s doing it for. That is sensible: Of course a startup is sophisticated and filled with nuance. However buyers don’t want that stage of in-the-weeds precision, particularly not the primary time they take a look at a startup. CommandBar’s second slide cuts by way of the temptation of complexity, providing up the next:

[Slide 2] Distill your objective in as few phrases as you’ll be able to. Picture Credit: CommandBar

It’s uncommon {that a} product-led pitch works effectively, however CommandBar is completely different right here, too. Being a “search-based interface for interacting with software program” explains the what, and enabling “internet apps to configure command bars” explains the how. “Leveling up their UX” reveals why CommandBar can profit firms. That is nice, and reveals that the founders actually perceive CommandBar’s why.

Three issues that might be improved

Intelligent improvements apart, there’s quite a bit to be desired with this deck.

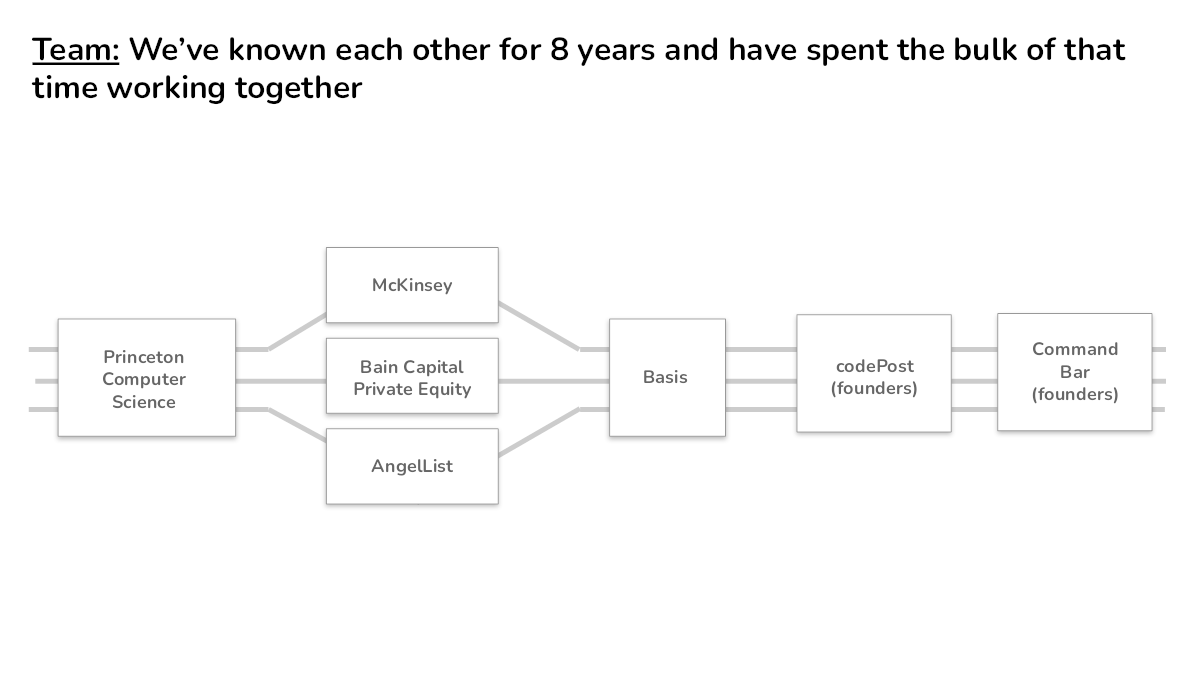

The group slide doesn’t have a group on it

[Slide 7] The place is the group? Picture Credit: CommandBar

Princeton, McKinsey, Bain Capital, AngelList are all spectacular, however nothing about this slide suggests why CommandBar’s founding group is the very best group to run this firm. And that’s not all; the group slide is usually crucial slide in a deck. It ought to spotlight the group’s deep expertise, connections or the rest that offers this explicit startup a aggressive edge.

There’s lacking info

The deck doesn’t embody sufficient info to know whether or not it’s enterprise scale. There’s no actual sense of how large the market is. There’s no ask or use of funds. The group is lacking. There’s no monetary plan, no enterprise mannequin, and no go-to-market plan. There’s no clear pricing or unit economics. There’s no readability round who the goal prospects are, how this firm is likely to be defendable, or why now’s the proper time to begin the corporate.

Picture Credit: Haje Kamps

For reference, my AI-powered pitch deck instrument gave this deck a 16.9% probability at elevating funding.

You want traction

CommandBar’s deck has no actual traction metrics, which isn’t nice. Even when there’s no income, at the very least some work has been achieved to de-risk the corporate. That’s the traction; report it and present it as graphs.

So, what occurred?

It’s probably that CommandBar raised its spherical with no deck in any respect and that buyers got here into the pitch realizing extra concerning the firm than we see right here. Maybe the group is extraordinary, and the buyers knew that as a result of they invested in a earlier firm, or have had publicity to the founders up to now. Maybe the corporate did a compelling demo when it was in Y Combinator.

I requested the founding group about what truly occurred.

“Vinay, Richard and I are overthinkers, so earlier than writing our seed deck we created some ideas,” stated CommandBar’s CEO and co-founder, James Evans. The corporate took an uncommon tack: “We checked out our seed deck as a memo to ourselves of why we — self-proclaimed good individuals who may do a bunch of different issues with their time — ought to make investments the following decade+ of our blood, sweat and tears into this firm. If that have been clear and we may fairly persuade ourselves, conveying that message to draw capital must be simple. And if it weren’t . . . then why have been we losing time making an attempt to lift cash for this firm to start with?”

Evans truly tore down the corporate’s deck himself in a current weblog publish, which makes for an excellent behind-the-scenes learn (I hadn’t learn it earlier than I wrote my teardown above). He instructed me that whereas the corporate might or is probably not elevating one other spherical of funding (shhhh), it did increase its subsequent spherical with no deck, saying “it wasn’t a conventional course of.”

“We led the A due to a continuation of things that have been current on the seed — a group with nice ambition + clear pondering, and a product that prospects liked and you can see turning into ubiquitous,” stated Itai Tsiddon, when TechCrunch requested him how the Collection A spherical got here collectively. “The stellar early buyer traction, with some marquee logos, definitely helped!”

The complete pitch deck

If you would like your personal pitch deck teardown featured on TechCrunch, right here’s extra info. Additionally, take a look at all our Pitch Deck Teardowns all collected in a single useful place for you!